In 2008, FDS also reported an unusual expense of $189.1 million related to restructuring costs and

asset write downs.

In 2008, FDS also reported an unusual expense of $189.1 million related to restructuring costs and

asset write downs.

In response to questions from a colleague, Emery makes the following statements regarding the

merits of earnings yield compared to the P/E ratio:

Statement 1: For ranking purposes, earnings yield may be useful whenever earnings are either

negative or close to zero.

Statement 2: A high E/P implies the security is overpriced.

According to FDS's price-to-sales ratio for 2008, based on the post-expansion announcement stock

price, FDS is:

In response to questions from a colleague, Emery makes the following statements regarding the

merits of earnings yield compared to the P/E ratio:

Statement 1: For ranking purposes, earnings yield may be useful whenever earnings are either

negative or close to zero.

Statement 2: A high E/P implies the security is overpriced.

According to FDS's price-to-sales ratio for 2008, based on the post-expansion announcement stock

price, FDS is: 2. The Neoclassical Growth Era o/Alphia (1951-1990)

During the neoclassical growth period, Alphia experienced a period of great economic growth. For

example, from 1986 to 1990, Alphia's capital per hour of labor grew at a 9% annual rate, while real

GDP grew at 7% per annum.

Also, Alphia was able to achieve economic growth rates and income levels comparable with many of

its neighboring countries during the neoclassical growth period. Alphian scientists, together with the

engineering department of the University of Ullom, provided access to the finest technology in the

world. In addition, Alphia opened up its equity markets to outside investors and allowed its currency

to float. Dr. Satish believes that, given time, these capital market improvements should allow the

Alphian economy to achieve an economic growth rate and per capita income level comparable to any

country in the world.

To understand the role of technology in the growth of the Alphian economy (using neoclassical

growth theory assumptions), the following table was developed to show the increased productivity

of Alphian farmers using disease resistant grains. Assume new disease resistant grain technology was

introduced into the Alphian farm economy at Point A.

2. The Neoclassical Growth Era o/Alphia (1951-1990)

During the neoclassical growth period, Alphia experienced a period of great economic growth. For

example, from 1986 to 1990, Alphia's capital per hour of labor grew at a 9% annual rate, while real

GDP grew at 7% per annum.

Also, Alphia was able to achieve economic growth rates and income levels comparable with many of

its neighboring countries during the neoclassical growth period. Alphian scientists, together with the

engineering department of the University of Ullom, provided access to the finest technology in the

world. In addition, Alphia opened up its equity markets to outside investors and allowed its currency

to float. Dr. Satish believes that, given time, these capital market improvements should allow the

Alphian economy to achieve an economic growth rate and per capita income level comparable to any

country in the world.

To understand the role of technology in the growth of the Alphian economy (using neoclassical

growth theory assumptions), the following table was developed to show the increased productivity

of Alphian farmers using disease resistant grains. Assume new disease resistant grain technology was

introduced into the Alphian farm economy at Point A.

3. The New Growth Era (1991-Today)

Since the Alphian energy crises of the late 1980s, the economy has been in transition. The AEDA goal

is to have more than 50% of Alphian GDP coming from what we now call knowledge capital based

industries by the year 2020. Given the large and growing population and their constant need for

health care, the pharmaceutical industry was Alphia's first knowledge capital based industry. Dr.

Satish believes that a focus on knowledge capital will enhance the long term growth prospects of

Alphia's economy.

According to the classical growth theory, Alphia would:

3. The New Growth Era (1991-Today)

Since the Alphian energy crises of the late 1980s, the economy has been in transition. The AEDA goal

is to have more than 50% of Alphian GDP coming from what we now call knowledge capital based

industries by the year 2020. Given the large and growing population and their constant need for

health care, the pharmaceutical industry was Alphia's first knowledge capital based industry. Dr.

Satish believes that a focus on knowledge capital will enhance the long term growth prospects of

Alphia's economy.

According to the classical growth theory, Alphia would: Smith has discovered that WMC has a small subsidiary in Ukraine. The Subsidiary follows IAS

accounting rules and uses FIFO inventory accounting. The Ukrainian subsidiary was acquired ten

years ago and has been fully integrated into WMC's operations. WMC obtains funding for the

subsidiary whenever the company finds profitable investments within Ukraine or surrounding

countries. According to forecasts from economists, the Ukrainian currency is expected to depreciate

relative to the U.S. dollar over the next few years. Local currency prices are forecasted to remain

stable, however.

One of the managers at WMC asks Smith to analyze a third subsidiary located in India. The manager

has explained that real interest rates in India over the last three years have been 2.00%, 2.50%, and

3.00%, respectively, while nominal interest rates have been 34.64%, 29.15%, and 25.66%,

respectively. Smith requests more time to analyze the Indian subsidiary.

Which of the following statements regarding the consolidation of WMC's Ukrainian subsidiary for the

next year is least likely correct? As compared to the temporal method, the Ukrainian subsidiary's

translated:

Smith has discovered that WMC has a small subsidiary in Ukraine. The Subsidiary follows IAS

accounting rules and uses FIFO inventory accounting. The Ukrainian subsidiary was acquired ten

years ago and has been fully integrated into WMC's operations. WMC obtains funding for the

subsidiary whenever the company finds profitable investments within Ukraine or surrounding

countries. According to forecasts from economists, the Ukrainian currency is expected to depreciate

relative to the U.S. dollar over the next few years. Local currency prices are forecasted to remain

stable, however.

One of the managers at WMC asks Smith to analyze a third subsidiary located in India. The manager

has explained that real interest rates in India over the last three years have been 2.00%, 2.50%, and

3.00%, respectively, while nominal interest rates have been 34.64%, 29.15%, and 25.66%,

respectively. Smith requests more time to analyze the Indian subsidiary.

Which of the following statements regarding the consolidation of WMC's Ukrainian subsidiary for the

next year is least likely correct? As compared to the temporal method, the Ukrainian subsidiary's

translated: Which of the following best describes the regulation being considered by the Wakullian government

for the electrical utility industry?

Which of the following best describes the regulation being considered by the Wakullian government

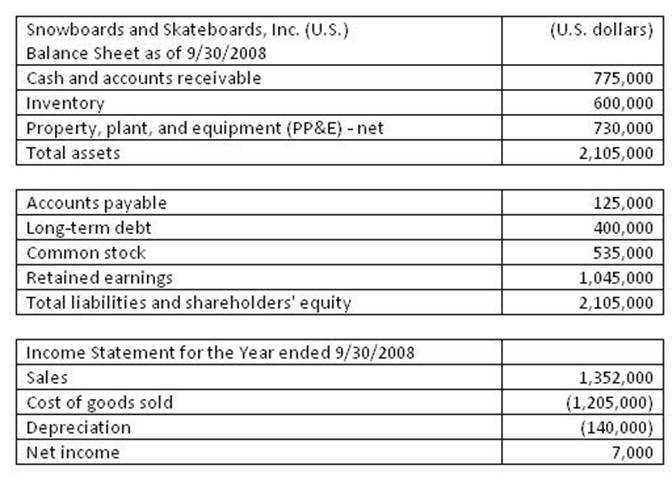

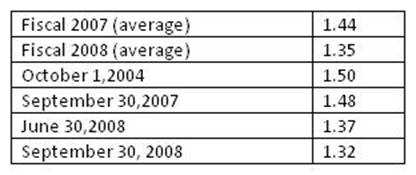

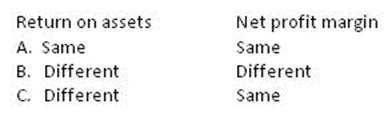

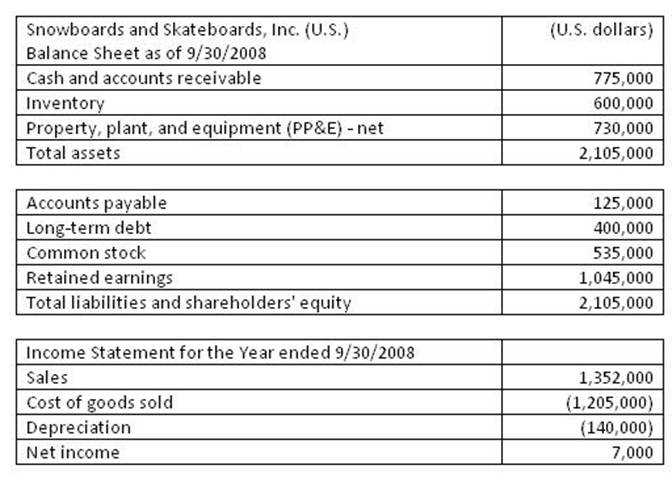

for the electrical utility industry?Ota L'Abbe, a supervisor at an investment research firm, has asked one of the junior analysts, Andreas Hally, to draft a research report dealing with various accounting issues. Excerpts from the request are as follows: • “There's an exciting company that we're starting to follow these days. It's called Snowboards and Skateboards, Inc. They are a multinational company with operations and a head office based in the resort town of Whistler in western Canada. However, they also have a significant subsidiary located in the United States." • "Look at the subsidiary and deal with some foreign currency issues including the specific differences between the temporal and all-current methods of translation, as well as the effect on financial ratios." • "The attached file contains the September 30, 2008, financial statements of the U.S. subsidiary. Translate the financial statements into Canadian dollars in a manner consistent with U.S. GAAP." The following are statements from the research report subsequently written by Hally: Statement 1: Subsidiaries whose operations are well integrated with the parent will use the all- current method of translation. Statement 2: Self-contained, independent subsidiaries whose operating, investing, and financing activities are primarily located in the local market will use the temporal method of translation.

Ota L'Abbe, a supervisor at an investment research firm, has asked one of the junior analysts, Andreas Hally, to draft a research report dealing with various accounting issues. Excerpts from the request are as follows: • “There's an exciting company that we're starting to follow these days. It's called Snowboards and Skateboards, Inc. They are a multinational company with operations and a head office based in the resort town of Whistler in western Canada. However, they also have a significant subsidiary located in the United States." • "Look at the subsidiary and deal with some foreign currency issues including the specific differences between the temporal and all-current methods of translation, as well as the effect on financial ratios." • "The attached file contains the September 30, 2008, financial statements of the U.S. subsidiary. Translate the financial statements into Canadian dollars in a manner consistent with U.S. GAAP." The following are statements from the research report subsequently written by Hally: Statement 1: Subsidiaries whose operations are well integrated with the parent will use the all- current method of translation. Statement 2: Self-contained, independent subsidiaries whose operating, investing, and financing activities are primarily located in the local market will use the temporal method of translation.