AAFM CWM_LEVEL_2 Exam Questions 2025

Our CWM Level II Exam Questions offer authentic, current questions for the Chartered Wealth Manager (CWM) Level II certification, thoroughly reviewed by certified experts. You’ll receive verified answers, detailed explanations—including guidance on incorrect choices—and access to our interactive online simulator. Try free sample questions below and see why professionals rely on Cert Empire for effective exam preparation.

What Users Are Saying:

About AAFM CWM_LEVEL_2 Exam

What is the AAFM CWM Level 2 Exam, and what will you learn from it?

The AAFM Certified Wealth Manager (CWM) Level 2 exam is designed for finance professionals seeking advanced knowledge and expertise in wealth management. This exam builds on foundational concepts from CWM Level 1 and focuses on sophisticated portfolio management strategies, financial planning, risk management, and advanced investment analysis.

Preparing for this exam equips you with the ability to:

- Design and manage complex investment portfolios

- Apply advanced financial planning techniques

- Understand tax, estate, and retirement planning implications

- Evaluate alternative investments and risk-return profiles

- Implement strategies for wealth preservation and growth

Passing this certification demonstrates to clients and employers that you have professional-level competency in wealth management. Practicing with the best exam questions from Cert Empire ensures you are familiar with real exam scenarios and gain confidence before attempting the test.

Exam Snapshot

| Attribute | Details |

|---|---|

| Exam Code | CWM Level 2 |

| Exam Name | Certified Wealth Manager – Level 2 |

| Vendor | AAFM (American Academy of Financial Management) |

| Version / Year | Current version (2023–2024) |

| Average Salary | 90,000 to 150,000 USD annually |

| Cost | 695 USD for members, 795 USD for non-members |

| Exam Format | Multiple choice, case study-based |

| Duration | 2.5 hours |

| Delivery Method | Online proctored or testing center |

| Languages | English |

| Scoring Method | Percentage-based |

| Passing Score | 70% |

| Prerequisites | CWM Level 1 certification or equivalent financial knowledge |

| Retake Policy | Retakes allowed per AAFM policy |

| Target Audience | Financial planners, wealth managers, investment advisors, private bankers |

| Certification Validity | 3 years, with continuing education requirements |

| Release Date | 2023 |

Prerequisites before taking the CWM Level 2 Exam

- Completion of CWM Level 1 certification or equivalent foundational knowledge in wealth management

- Understanding of investment products, portfolio theory, and risk management principles

- Familiarity with financial planning concepts, tax planning, and estate planning basics

- Experience in client advisory, asset management, or related financial roles

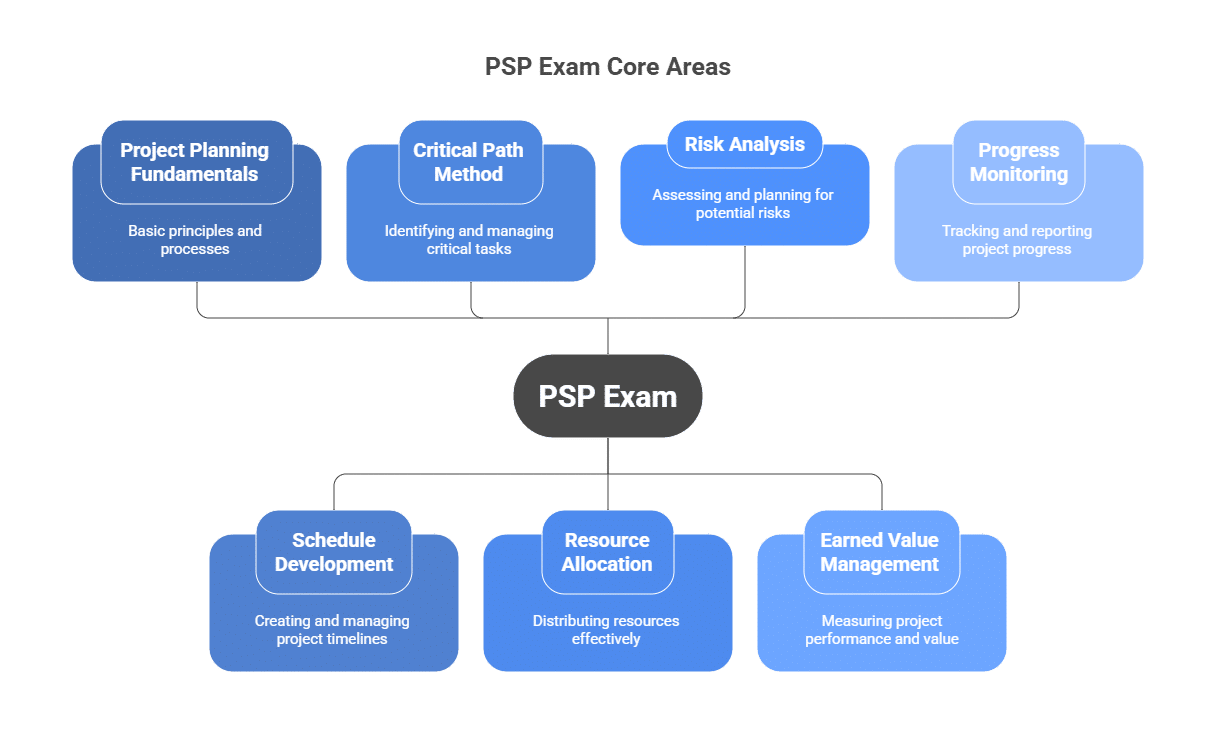

Main objectives and domains you will study for CWM Level 2

The exam focuses on advanced wealth management skills including:

- Portfolio construction and optimization

- Advanced financial planning techniques

- Risk management and asset allocation strategies

- Tax, retirement, and estate planning considerations

- Alternative investments, derivatives, and structured products

- Ethical standards and compliance in wealth management

Topics to cover in each exam domain

Portfolio Management

- Asset allocation, diversification, and portfolio optimization

- Performance measurement, benchmarking, and portfolio rebalancing

Financial Planning

- Advanced retirement planning, estate planning, and tax-efficient strategies

- Cash flow modeling and wealth preservation

Risk Management

- Identifying investment and market risks

- Using derivatives and hedging strategies

- Risk-adjusted performance evaluation

Alternative Investments

- Real estate, private equity, hedge funds, and structured products

- Evaluating risk-return trade-offs

Ethics and Compliance

- Fiduciary responsibilities

- Regulatory requirements for wealth managers

- Professional ethics in client advisory

Changes in the latest version of CWM Level 2

- Updated exam content to reflect current investment regulations and financial products

- Expanded coverage of alternative investments and derivatives

- Greater emphasis on tax planning, retirement strategies, and wealth preservation

- Enhanced case-study questions reflecting real-world client scenarios

Register and schedule your CWM Level 2 exam

You can register for the exam through the AAFM official website. Candidates may choose online proctored exams or authorized testing centers based on availability.

Exam cost and potential discounts

- 695 USD for AAFM members

- 795 USD for non-members

- Discounts may be available for bulk registrations, corporate packages, or during promotional periods

Exam policies you should know

- Valid government-issued identification is required

- No external reference materials allowed during the exam

- Online proctored exams are monitored for compliance

- Retakes follow AAFM-defined waiting periods

What can you expect on exam day?

- Case-study-based and multiple-choice questions

- Scenarios requiring application of advanced financial planning and investment strategies

- 2.5-hour duration requires effective time management

- Monitored environment ensures exam integrity

Plan your study schedule effectively with 8 Study Tips

- Review the AAFM CWM Level 2 syllabus and study guide thoroughly

- Practice portfolio construction and asset allocation exercises

- Work on case studies to understand real-world wealth management scenarios

- Analyze tax, retirement, and estate planning strategies

- Study alternative investments and derivatives in detail

- Practice risk-adjusted performance evaluation

- Take timed practice exams to simulate real exam conditions

- Use the best exam questions from Cert Empire to reinforce knowledge and exam readiness

Best study resources

- AAFM official study guides and recommended readings

- Financial planning and portfolio management textbooks

- Case studies on wealth management scenarios

- Online professional finance forums and discussion groups

- Targeted practice with Cert Empire exam questions to gain realistic exam experience

Career opportunities after earning CWM Level 2

- Wealth Manager / Private Banker

- Investment Advisor / Portfolio Manager

- Financial Planner / Retirement Planner

- Estate Planning Specialist

- Risk and Compliance Officer in wealth management firms

Certifications to pursue after completing CWM Level 2

- CWM Level 3 for mastery in advanced wealth management

- CFA (Chartered Financial Analyst) for investment-focused professionals

- CFP (Certified Financial Planner) for holistic financial planning expertise

- Alternative certifications in risk and portfolio management

How does CWM Level 2 compare to other wealth management certifications?

| Certification | Focus | Technical Depth | Primary Area | Ideal for |

|---|---|---|---|---|

| CWM Level 2 | Advanced wealth management | Intermediate to advanced | Portfolio management, financial planning, risk management | Financial advisors, wealth managers |

| CFP | Financial planning | Beginner to intermediate | Holistic financial planning | Financial planners, advisors |

| CFA | Investment management | Advanced | Portfolio and investment analysis | Portfolio managers, analysts |

| AIF | Alternative investments | Intermediate | Alternative assets and strategies | Wealth managers and private bankers |

5 reviews for AAFM CWM_LEVEL_2 Exam Questions 2025

Discussions

There are no discussions yet.

Natasha Wall (verified owner) –

The CWM Level 2 Dumps from Cert Empire provided a solid foundation for my studies. While I supplemented with other resources, these dumps were a valuable part of my preparation.

Jatan Shekhawat (verified owner) –

CWM_LEVEL_2 is a tough exam, but due to study resources, it’s now easy to pass it. But from what site? Well, I recommend Cert Empire. I bought from them and I’m 100% satisfied. Thanks.

Travis Jerome (verified owner) –

This level two certification was demanding, but steady use of practice tests improved my understanding. The study guide was very helpful.

Elias Donovan (verified owner) –

This study file made learning easy. Each topic was simple, and I could practice without getting tired. It helped me pass comfortably.

Juliette Vaughn (verified owner) –

Cert Empire sorted the CWM_LEVEL_2 file perfectly for mobile. The text stayed nice and clear, and the tables showed up properly, so those quick study sessions on the go actually felt productive.