AICPA CPA FINANCIAL

Q: 1

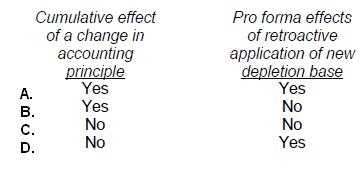

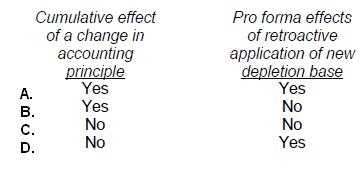

During 1992, Krey Co. increased the estimated quantity of copper recoverable from its mine. Krey

uses the units of production depletion method. As a result of the change, which of the following

should be reported in Krey's 1992 financial statements?

Options

Q: 2

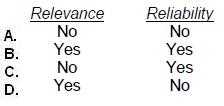

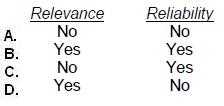

According to the FASB conceptual framework, predictive value is an ingredient of:

Options

Q: 3

In financial reporting of segment data, which of the following items is always used in determining a

segment's operating income?

Options

Q: 4

On December 31, 20X2, the Board of Directors of Maxy Manufacturing, Inc. committed to a plan to

discontinue the operations of its Alpha division. Maxy estimated that Alpha's 20X3 operating loss

would be $500,000 and that the fair value of Alpha's facilities was $300,000 less than their carrying

amounts.

Alpha's 20X2 operating loss was $1,400,000, and the division was actually sold for $400,000 less than

its carrying amount in 20X3. Maxy's effective tax rate is 30%.

In its 20X2 income statement, what amount should Maxy report as loss from discontinued

operations?

Options

Q: 5

Which of the following must be included in a company's summary of significant accounting policies in

the notes to the financial statements?

Options

Q: 6

Which of the following factors determines whether an identified segment of an enterprise should be reported in the enterprise's financial statements under SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information? I. The segment's assets constitute more than 10% of the combined assets of all operating segments. II. The segment's liabilities constitute more than 10% of the combined liabilities of all operating segments.

Options

Q: 7

Envoy Co. manufactures and sells household products. Envoy experienced losses associated with its

small appliance group. Operations and cash flows for this group can be clearly distinguished from the

rest of Envoy's operations. Envoy plans to sell the small appliance group with its operations. What is

the earliest point at which Envoy should report the small appliance group as a discontinued

operation?

Options

Q: 8

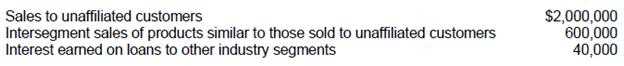

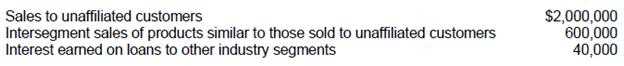

The following information pertains to Aria Corp. and its divisions for the year ended December 31,

1988:

Aria and all of its divisions are engaged solely in manufacturing operations. Aria has a reportable

segment if that segment's revenue exceeds:

Aria and all of its divisions are engaged solely in manufacturing operations. Aria has a reportable

segment if that segment's revenue exceeds:

Aria and all of its divisions are engaged solely in manufacturing operations. Aria has a reportable

segment if that segment's revenue exceeds:

Aria and all of its divisions are engaged solely in manufacturing operations. Aria has a reportable

segment if that segment's revenue exceeds:Options

Q: 9

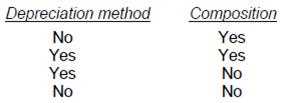

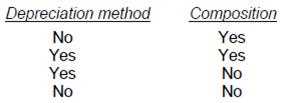

Which of the following facts concerning fixed assets should be included in the summary of significant

accounting policies?

Options

Q: 10

A transaction that is unusual, but not infrequent, should be reported separately as a(an):

Options

Question 1 of 10