CIMA CIMAPRA17 BA3 1

Q: 1

Life membership fees payable to a club or society are usually dealt with by:

Options

Q: 2

Which of the following is not a book of prime entry?

Options

Q: 3

The Accounting Standards Board is responsible for:

Options

Q: 4

Company P are looking to create a balance sheet. Which of the following should be included in this

document?

Options

Q: 5

A non-current asset was purchased for £240000 at the beginning of Year 1, with an expected life of 7

years and a residual value of £50000. It was depreciated by 20% per annum using the reducing

balance method.

At the beginning of Year 4 it was sold for £100000. The result of this was:

Options

Q: 6

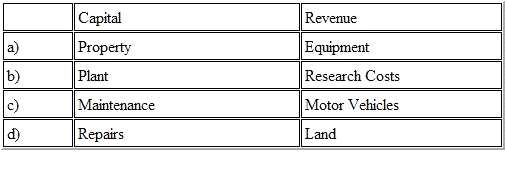

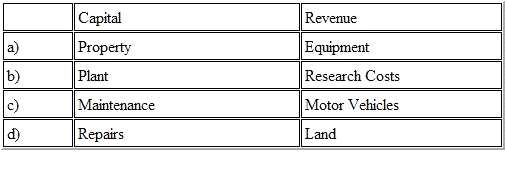

Refer to the Exhibit.

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?Options

Q: 7

The sales ledger control account shows a balance of £236,725, whilst the individual customer

balances total £231,472.

One possible explanation for the difference between the two may bE.

Options

Q: 8

Which of the following does not necessarily need to be true for something to be treated as an asset

in an entity's statement of financial position?

Options

Q: 9

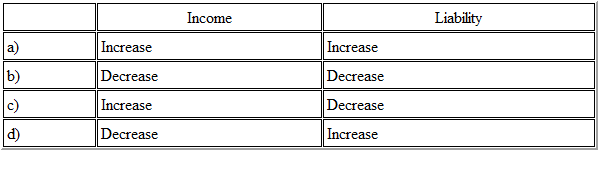

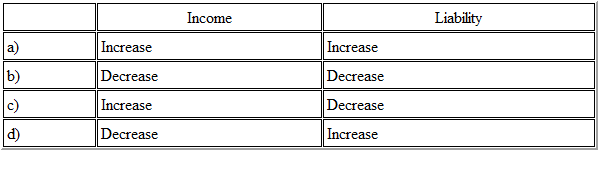

Refer to the Exhibit.

A business banks its takings for the week. The bank account at the start of the week shows an

overdraft

Which of the following is the dual effect?

A business banks its takings for the week. The bank account at the start of the week shows an

overdraft

Which of the following is the dual effect?

A business banks its takings for the week. The bank account at the start of the week shows an

overdraft

Which of the following is the dual effect?

A business banks its takings for the week. The bank account at the start of the week shows an

overdraft

Which of the following is the dual effect?Options

Q: 10

A company that is VAT-registered has sales for the period of $245,000 (excluding VAT) and purchases

for the period of $123,375 (including VAT). The opening balance on the VAT account was $18,000

credit. The VAT rate is 17.5%.

What will be the closing balance on the VAT account at the end of the period?

Options

Question 1 of 10