If you have been thinking about a career in healthcare but don’t want to work directly with patients, medical coding is probably already on your radar. It’s a field that continues to grow as hospitals, clinics, and insurance companies rely on coders to keep records accurate and billing smooth. And of course, one of the biggest questions people ask is, “How much do medical coders make in 2025?”

Salaries in this profession aren’t just numbers, they reflect demand, certifications, and even where you live. In this guide, we’ll break down the latest salary trends for medical coders in 2025, so you know exactly what to expect before stepping into or leveling up in this career. For additional career paths, you can also explore more through healthcare certifications.

What does this guide cover?

Here’s your map. Skim now, dive deep where you need a signal.

| Topic | You’ll learn | Why it matters |

| A clear view of medical billing and coding salary in 2025 | Where 2025 pay lands for coders and billers (national snapshot).How to read ranges vs medians from BLS/AAPC/AHIMA.What “total comp” really includes beyond base pay. | Know the market so you don’t under-ask. Anchor your expectations before applying or negotiating. |

| What drives pay: credentials, experience, setting, specialty, and state | How certs (CPC, CCS, RHIA, CPB, CRC, CPMA) shift bands.Experience, QA rates, and case mix as levers.Setting and specialty impacts (inpatient DRG, HCC, surgery subs).State/metro effects and remote competition. | Target the highest-return mix for your lane and location. Stop guessing which skill to level up. |

| Hourly vs annual pay, remote vs onsite, W2 vs 1099 | Compare annual salary vs medical billing and coding salary per hour.Benefits math: PTO, health, retirement, CEUs, overtime.Remote productivity expectations; location-based pay policies.Contracting (1099) rates, taxes, and self-funded training. | Pick the right pay format for your season of life and tax picture. Keep more of what you earn. |

| Certifications that move the needle (and where to get official info) | Which certs unlock roles fast vs those for senior tiers.Official pages for requirements, exam outlines, renewal costs.Smart stacks: CPC → CRC/CPMA; CCA → CCS; RHIT → RHIA. | Certs are market signals. Choose ones hiring managers actually filter for. |

| Simple steps to increase your medical coding salary fast | 90-day plan: one credential, one specialty, measurable metrics.Shift to higher-value work (HCC, surgery, inpatient) with proof of accuracy.Use data in negotiations: charts/hour, accuracy %, denial reductions.Apply broadly, include remote roles; align asks with current comps. | Fast wins, not fluff. Move your rate, role, or both—on purpose. |

Quick tip to get the most from this guide:

- Skim the salary snapshot first, then jump to the driver (cert, setting, or state) that applies to you.

Quick Snapshot: Where Salary Sits in 2025

Short answer: entry roles cluster in the low–to–mid $50Ks, certified coders average in the $60Ks, and complex lanes (inpatient, auditing, HCC) commonly stretch into the $70K–$90K range. Hourly, that’s roughly $22–$45+ for W2, with seasoned 1099 contractors reaching higher on niche work.

| Source lens | What it covers | 2025 takeaway (national) |

|---|---|---|

| BLS – Medical Records Specialists | All-comers in health info roles (coding + non-coding) | Median lands in the upper-$40Ks to low-$50Ks; hourly roughly $23–$26. Good floor for entry pay. |

| AAPC – Annual Salary Survey | Certified coders/billers (CPC, CPB, CRC, etc.) | Averages commonly in the $60K–$70K band; stacked certs and high-demand specialties trend higher. |

| AHIMA – Workforce/Salary insights | Hospital-focused and advanced credentials (CCS, RHIT, RHIA) | Inpatient and leadership paths often sit mid-$60Ks to $80K+, depending on role scope and metro. |

| Role / Scenario | Typical annual (W2) | Typical hourly (W2) | Common 1099 range | Notes |

| Entry coder/biller (training + first cert) | $45K–$55K | $21–$27 | $25–$35 | Primary care, E/M heavy; onsite/mentored roles. |

| Outpatient/pro-fee coder (CPC/COC) | $58K–$72K | $26–$35 | $35–$50 | Multi-specialty, OP surgery, E/M mastery pays. |

| Inpatient facility coder (CCS/CIC) | $70K–$90K | $32–$43 | $40–$60 | DRG/APC, CDI collaboration, higher complexity. |

| Risk adjustment coder (CRC, HCC) | $65K–$85K | $30–$40 | $40–$70 | Seasonal spikes; per-chart pay common. |

| Auditor/Educator (CPMA/CDEO/RHIA) | $75K–$95K | $34–$46 | $45–$75 | QA leadership, education, payer/vendor demand. |

| Medical biller/RCM specialist (CPB) | $50K–$65K | $24–$31 | $28–$45 | Denials/appeals and AR cleanup nudge rates up. |

Understanding the Salary Data

These salary bands are based on a blend of trusted sources, including:

- BLS (Bureau of Labor Statistics) baselines for Medical Records Specialists

- AAPC survey averages

- AHIMA insights

- Live job postings

Keep in mind that local markets can sit well above or below these benchmarks.

Note: Hourly estimates assume ~2,080 hours per year for simple annual conversion. Benefits, differentials, and bonuses are not included.

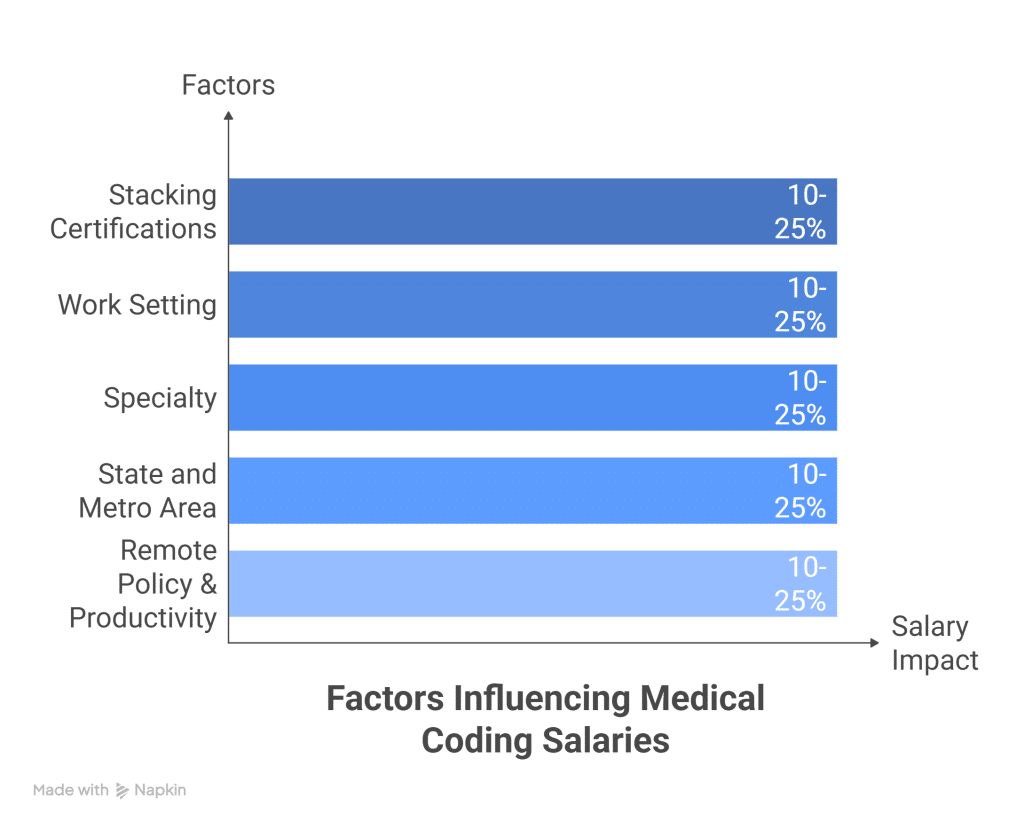

Key Factors That Influence Medical Coding Salaries

Certification Stack

- A single certification (such as CPC or CCA) typically anchors pay.

- Stacking certifications (e.g., CPC + CRC or CCS + CPMA) can boost earnings by 10–25% in competitive metropolitan areas.

Work Setting

- Hospital inpatient/outpatient roles and academic medical centers generally pay more than small private practices.

- Payers and vendors may offer premium pay for coders with strong productivity and audit skills.

Specialty

- Certain specialties consistently command higher pay, including:

- HCC risk adjustment

- Interventional radiology/cardiology

- Orthopedics

- General surgery

- Anesthesia

- By contrast, primary care/E/M-only coding tends to fall on the lower end of the salary spectrum.

State and Metro Area

- High-cost, high-demand metros and regions with a dense employer base push salaries toward the top of the range.

- Rural markets often pay less but balance it out with a lower cost of living.

Remote Policy & Productivity Metrics

- Some employers pay based on the employee’s location, while others use national pay bands.

- Your pay can also be influenced by:

- QA (quality assurance) rate

- Charts coded per hour

- Audit scores

- Strong performance in these areas can unlock tiered pay increases, bonuses, or contract uplifts.

Pro Move: How to Set Your Salary Ask

To find your most accurate salary expectation:

- Confirm your target pay range against at least two sources (for example, BLS + AAPC or AHIMA).

- Compare your findings with at least three current job postings in your target state and specialty.

- Use this comparison to set a tight, well-informed salary task.

What Medical Coders and Billers Do (and Why It Matters for Pay)

Medical coding and billing are the backbone of healthcare revenue cycle management. The accuracy, complexity, and specialty of these roles directly influence salaries. Let’s break down what each role involves, and why certain tasks command higher pay.

Medical Coders

Core Role

Medical coders translate clinical documentation into structured codes that drive reimbursement and analytics. This includes:

- ICD-10-CM → diagnoses

- CPT and HCPCS Level II → procedures, supplies, drugs

- MS-DRGs → inpatient facility payment

- APCs → outpatient facility payment

Work Lanes in Coding

- Inpatient facility: full chart review, principal diagnosis, POA status, procedures, CC/MCC capture, DRG validation, CDI collaboration

- Outpatient facility: APC logic, status indicators, modifiers, NCCI edits, MUEs

- Professional (pro-fee): E/M leveling, procedure coding, modifier mastery (e.g., 25, 59/XS), payer-specific bundling

- Risk adjustment (HCC): chronic condition capture using MEAT criteria for Medicare Advantage & ACA plans

- Surgical subspecialties: ortho, general surgery, neuro, cardio, interventional radiology, dense guidelines, high financial impact

Accuracy, Specificity & Compliance

- Specificity → boosts payment accuracy and reduces denials

- Vague codes → risk recoups and compliance issues

- QA targets → often sit at 95–98%+, supported by ongoing audits

- Rules live across ICD-10-CM/CPT guidelines, NCCI Policy Manual, payer bulletins

Quick Coding Examples

- E/M (2021+): select code by MDM or time; assess data complexity vs. risk

- Ortho op note: arthroscopy with meniscectomy—bundle, laterality, approach all matter

- HCC: diabetes with chronic kidney disease must be clearly linked in documentation

Tools of the Trade

- Encoders (3M, Optum)

- CAC/AI coding assistants

- EHRs (Epic, Cerner)

- Claim scrubbers

- Payer portals

Medical Billers

Core Role

Medical billers keep revenue flowing across the claim lifecycle, from verification to payment posting.

Key Responsibilities

- Benefits verification and prior authorization

- Clean claim submission (837P/837I) via EDI; clearinghouse edit management

- Payment posting: ERAs (835), EOB reconciliation, remit code resolution

- Denial/rejection work: evidence-based appeals, denial root cause analysis

- Accounts receivable (A/R): managing aging claims, reducing days in A/R

Payer Policy Fluency

- Understands LCDs/NCDs, timely filing limits, place-of-service rules, bundling edits

- Deciphers denial codes (e.g., CO-97, CO-50) and fixes issues at the source

Metrics That Matter

- First-pass acceptance rate

- Denial rate

- Days in A/R (DSO)

- Net collection rate

- Credit balance management

Common Tools

- Clearinghouses (Availity, Change Healthcare)

- Payer portals

- RCM platforms

- Excel with pivots & formulas

- Light RPA for claim status checks

Hybrid Roles in the Revenue Cycle

- Revenue Cycle Specialist → bridges coding, billing, and prior auth for higher first-pass yield

- Coding Auditor/Educator → pre-bill & retrospective audits, provider education, trend reporting (often CPMA, CDEO, or CCS credentialed)

- CDI Collaborator → improves clinical specificity through queries aligned with coding guidelines

- Compliance Analyst → tracks OIG/CMS updates, runs audits, develops policy and training

Why This Matters for Pay

- Complexity & Scarcity Drive Pay → Inpatient DRG coding, interventional radiology/cardiology, advanced surgical coding, and HCC auditing land at the top of salary ranges.

- Revenue-Impact Roles Pay More → Auditing, CDI, and denial prevention directly affect reimbursement and compliance, making them highly valued.

- Metrics Back Negotiations → Demonstrating charts/hour, QA rate, denial reduction, or appeal win rate strengthens your case for higher pay.

| Role/Focus | Core tasks | Common metrics | Tooling | Pay signal |

| Inpatient coder (DRG) | Principal dx/proc selection, CC/MCC capture, DRG validation, CDI queries | DRG accuracy, query rate/response, audit pass %, cases/day | 3M/Optum encoder, Epic/Cerner, CAC | Higher—complexity and revenue impact |

| Pro-fee coder (multi-specialty) | E/M leveling, procedures, modifiers, NCCI checks | QA %, charts/hour, denial rate linked to coding | Encoder, scrubber, payer portals | Moderate → higher with specialty depth |

| Risk adjustment coder (HCC) | Chronic condition capture, MEAT validation, suspect list review | HCC accuracy, recapture %, records/hour, audit results | RA tools, EHR extracts, CAC/AI assist | Higher—seasonal demand, strong hourly/project rates |

| Medical biller / A/R specialist | Claim edits, denials/appeals, posting, payer follow-up | First-pass rate, denial rate, DSO, net collection rate | Clearinghouse, payer portals, RCM platform | Moderate → higher with denial prevention wins |

| Auditor/Educator or CDI | Pre-bill audits, provider training, queries, policy/compliance | Audit variance, education impact, compliance scores | Audit suites, reporting dashboards | Higher—enterprise risk and revenue integrity |

Quick glossary (useful in job posts and interviews):

- ICD-10-CM: diagnosis codes; CPT/HCPCS: procedures/supplies

- DRG/APC: facility payment groupers

- E/M: evaluation and management coding rules

- NCCI/MUE: Medicare edit logic to prevent improper combinations/overuse

- HCC + MEAT: risk codes for chronic conditions; documentation must show Monitor/Evaluate/Assess/Treat

- EDI 837/835: claim and remit transaction files

Factors That Shape Your Medical Billing and Coding Salary

Here’s how hiring teams typically decide pay for coders and billers. Short version: your credentials, your proven output, and your work environment do the heavy lifting.

Certifications and Credentials

First Credential vs. Advanced Credentials

- Entry-level certs (like CPC or CCA) → open the door to initial roles.

- Advanced certs (like CCS, CRC, CPMA, CIC/COC, RHIT/RHIA) → unlock higher-paying lanes and specialized positions.

Certification Stacks That Signal Immediate Value

- CPC + CRC → positions you for risk adjustment/HCC projects and seasonal or hourly contract options.

- CCA → CCS → moves you into inpatient facility coding or DRG validation work.

- CPC + CPMA (or CDEO) → sets you up for a coding auditor/educator track.

- RHIT → RHIA → progression toward leadership roles with salaries tied to scope and KPIs.

Pro Resume Tip

On your resume, list your encoder and EHR fluency next to each certification. Recruiters actively scan for both credentials and system proficiency, and pairing them makes you stand out immediately.

| Credential/Stack | Signals To Employers | Best-Fit Settings | Typical Salary Impact |

| CPC (AAPC) | Solid outpatient/pro-fee coding, E/M rules, compliance basics | Physician groups, ambulatory surgery, vendors | Medium; strong baseline for medical coding specialist salary |

| CCA → CCS (AHIMA) | Facility coding depth, DRG/APC, complex case mix | Hospitals (inpatient/outpatient), revenue integrity | High for inpatient; boosts medical coding salary bands |

| CRC (AAPC) | Risk adjustment mastery, MEAT, HCC mapping | Medicare Advantage payers, seasonal projects | High on hourly/contract; strong remote pipeline |

| CPMA/CDEO (AAPC) | Auditing, provider education, denial prevention | Consulting, compliance, large multispecialty groups | High when tied to quality KPIs |

| RHIT/RHIA (AHIMA) | HIM leadership, policy, data oversight | Hospital systems, enterprise RCM, management roles | High for leadership pay ranges |

Experience and Productivity

In medical coding and billing, volume + accuracy = leverage. Employers are willing to pay more for professionals who consistently deliver high chart counts with strong QA rates.

What to Track (and Showcase)

To prove your value, keep clear metrics on:

- Encounters per day

- Case mix (E/M, surgery, inpatient, etc.)

- Accuracy/denial rates

- Time-to-first-pass (speed to clean claim submission)

Example Resume Bullets That Boost Offers

- “27 pro-fee charts/day at 96.8% QA for 6 months, ortho + cardiology”

- “Inpatient DRG validation: 3.2 cases/hr, 98% agreement with CDI”

If You’re New

Don’t worry if you lack high-volume metrics yet. You can offset limited experience with:

- Focused niche training (e.g., mastery of 2023+ E/M rules)

- Internships or externships that demonstrate applied skills

Work Setting and Pay Impact

Where you work has a direct effect on your salary and growth potential.

Hospital Systems

- Complex coding and frequent CDI collaboration

- In some regions, union contracts or step-scale pay structures

- Broader benefits and more stability

Specialty Groups

- Deep focus in one or two specialties (ortho, GI, cardiology, etc.)

- Productivity incentives and bonus structures are common

Payers

- Roles in risk adjustment, auditing, and policy

- Strong availability of remote work options

Vendors & Consulting Firms

- Exposure to diverse cases and rapid skill growth

- Often higher hourly rates, though benefits may vary

- Can involve travel or sprint project deadlines

| Setting | Pros | Watchouts | Salary Signal |

| Hospital (inpatient/outpatient) | Complexity, CDI partnership, pathway to lead roles | Stricter QA, credential preferences (CCS) | Higher bands for facility coders |

| Physician group (pro-fee) | Speed gains, specialty depth, bonus potential | Productivity pressure | Solid; spikes with surgery subspecialties |

| Payer / Health plan | Risk adjustment, auditing exposure, remote-first | Strict compliance cadence | Competitive; strong hourly for HCC |

| Vendor / Consulting | Project variety, fast ladder | Contracts ebb/flow; benefits vary | Higher hourly; project premiums |

Specialty Depth

Certain specialties pay more because they are scarce and require precision. High-value lanes include:

- Interventional radiology/cardiology

- Cardiothoracic surgery

- Neurosurgery

- Complex orthopedics

- Vascular surgery

- Anesthesia

- HCC risk adjustment

Facility vs. Pro-Fee Focus

- Facility side → DRG/APC logic, CC/MCC capture, POA indicators

- Professional (pro-fee) → modifiers, global periods, NCCI edits, MUEs

Action Move: Pick one high-value specialty and build artifacts that show mastery—such as cheat sheets, appeal templates, or before/after denial metrics.

Location and Remote Work

Salary by State

- Pay varies based on cost of living, hospital density, and payer competition.

Remote Work Nuance

- Some employers pay based on the employee’s location.

- Others anchor pay to HQ or a national band, so always ask early.

- Employer-of-record rules can limit which states they hire in, often tied to tax and compliance issues.

Shift and Schedule

- Evenings/weekends often come with pay differentials.

- PRN and seasonal HCC projects may outpay standard W2 hourly rates.

- Busy cycles include:

- Q4 HCC sweeps

- January benefit resets

- Fiscal year-end closes

- Surge pay or bonuses may apply during these periods.

If you’re flexible, say it, flexibility itself is a compensation lever.

Education and Leadership

- HIM degrees (associate or bachelor’s) with RHIT/RHIA credentials unlock lead, supervisor, and manager tiers. Pay in these roles is tied to KPIs such as:

- DNFB reduction

- Denial rate improvement

- Clean claim rates

Leadership Signals That Boost Pay

- Running QA huddles

- Leading provider education

- Owning productivity dashboards

Quick Ways to Raise Your Offer This Quarter

- Add one niche skill: “IR coding with selective vascular bundling” or “MEAT-compliant HCC capture”

- Document measurable results: “Cut avoidable denials 18% by modifier education; maintained 97% QA at 25 charts/day”

- Align certifications with your target role:

- Inpatient? → CCS

- Audits? → CPMA

- Risk Adjustment? → CRC

| Format | Typical range (US, 2024–2025) | Pros | Tradeoffs | Best for |

| Annual (W2) | ~$40,000–$100,000+ varies by certs, setting, state | Benefits, PTO, stability, career ladders | Fixed band; raises on review cycles | Full-time roles, long-term growth |

| Hourly (W2) | ~$20–$45/hr | Overtime eligible, predictable schedule | Rates tied to employer policy/location | Entry to mid-level, hospital/clinic teams |

| Hourly (1099) | ~$35–$75+/hr | Higher rate ceiling, flexible projects | No benefits; self-employment taxes; unpaid admin time | Experienced coders/auditors, niche specialties |

| Project / piece-rate | Per chart ~$3–$6 (HCC); per RVU ~$1.50–$3.00; DRG audits often $45–$85/hr | Pay for speed + accuracy; stackable projects | Quality penalties possible; seasonal volume | Fast, accurate coders; risk adjustment seasons |

Salary Ranges for Medical Coders and Billers in 2025

These ranges reflect BLS “Medical Records Specialists” data combined with recent AAPC/AHIMA salary surveys and posted job ranges. Always verify for your state, specialty, and employer before negotiating.

Annual Salaries

- Entry-Level (0–1 year, first cert like CPC or CCA): about $40,000–$54,000

- Mid-Level (2–5 years, second cert or specialty focus): about $55,000–$72,000

- Senior/Advanced (5+ years, inpatient/DRG, auditing, lead roles): about $73,000–$100,000+

What Nudges You Up a Band

- Certification stack → CPC + CRC/CPMA; CCA → CCS; RHIT/RHIA for leadership

- Complex settings → inpatient facilities, surgical subspecialties, payer/audit environments

- Proven metrics → charts/hour, QA accuracy ≥95%, denial reduction track record

Hourly Pay

- W2 hourly: typically $20–$35/hr; high-cost metros or niche roles can push $36–$45/hr

- 1099 contract: commonly $35–$60/hr; deep specialties or audit gigs can reach $70+/hr

Overtime Rules

- Most coding/billing roles are non-exempt, meaning time-and-a-half after 40 hours/week

- State rules may enhance overtime pay

- Holiday/weekend premiums vary by employer → always confirm in writing

Productivity Bonuses

Employers often tie bonuses to measurable outputs:

- Triggers: charts/day, RVUs, error rates, clean-claim percentage

- Structures:

- Cents-per-chart kicker

- Monthly lump-sum

- Tiered rate bumps

Project and Piece-Rate Work

Some coding/billing roles shift from hourly or annual pay to per-project or per-chart compensation.

Where You’ll See It

- Risk adjustment chart reviews (Medicare Advantage HCC)

- Backlog cleanups, E/M re-score, surgery coding sprints

- DRG validation and compliance audits (often hourly, sometimes per-case)

How to Evaluate Per-Chart or Per-RVU Pay

Step 1: Estimate your sustained throughput (charts/hr or RVUs/hr)

Step 2: Confirm quality thresholds and clawbacks (e.g., must maintain >95% QA)

Step 3: Account for unpaid time (EHR login, meetings, feedback cycles)

Step 4: Compute effective hourly

- Per chart:

Effective rate = (pay_per_chart × charts_per_hour) × (1 − penalty_rate) − unpaid_time_cost - Per RVU:

Effective rate = (pay_per_RVU × RVUs_per_hour) × (1 − penalty_rate) − unpaid_time_cost

| Scenario | Quoted pay | Throughput | Quality/overhead | Effective hourly (approx.) |

| HCC chart review | $3.50 per chart | 12 charts/hr | 5% QA clawback; ~5 min admin/hr | ≈ $39–$41/hr |

| Pro-fee surgery (per RVU) | $2.00 per RVU | 18 RVUs/hr | 2% QA penalty risk | ≈ $35–$36/hr |

| DRG validation (hourly) | $65/hr (1099) | Case-mix varies | ~15% unpaid admin | ≈ $55–$57/hr net of overhead |

Tips to lock in a strong rate quickly:

- Put your metrics on the table: charts/hour, RVUs/hour, QA %, denial wins

- Ask for the structure in writing: rate, bonuses, QA thresholds, overtime/holiday rules

- For 1099: factor taxes, CEUs, benefits equivalent, and any non-billable time

- Re-check ranges using BLS (Medical Records Specialists), the AAPC salary survey, AHIMA insights, and current job postings in your state/specialty

Medical Coding Salary by State

Medical coding pay isn’t random, it closely maps to where you work and who you work for.

What Drives Salary Differences

- Cost of living & pay bands → Employers set ranges by local COL or geo tiers (national, high-cost, low-cost markets).

- Statewide payer mix → Heavy Medicare Advantage and complex commercial plans can boost pay (risk adjustment, denials work).

- Hospital density & case complexity → Academic medical centers, Level I trauma hospitals, and integrated systems push salaries up.

- Remote competition → National employers hire in lower-cost states, while local employers must compete with remote offers.

- Certification supply → In states with fewer CCS/CPC coders, advanced credentials earn a premium.

States and Regions That Often Pay Higher

- High-paying states/regions: California, New York (downstate), Massachusetts, Washington, Colorado (Front Range), New Jersey/Connecticut, DC/Maryland/Virginia corridor

- High-paying metros: Bay Area, Los Angeles, NYC, Boston, Seattle, DC, Denver

Why these pay more:

- High cost of living

- Complex healthcare systems

- Union presence in some facilities

- Robust payer and insurance mix

Always verify with BLS (Medical Records Specialists) and the latest AAPC salary survey for up-to-date numbers.

States Where Pay Is Typically Lower

- Lower-paying states: Alabama, Arkansas, Mississippi, Oklahoma, West Virginia, South Dakota, New Mexico, parts of the Midwest

Why these pay less:

- Lower cost of living

- Smaller hospital networks

- Fewer complex payer mixes

But the offset:

- Lower housing costs

- Reduced taxes in some states

- Minimal commute costs → strong take-home value

Strategy: Coders in lower-paying states can close the gap by:

- Targeting remote roles

- Joining seasonal HCC projects

- Building specialty depth in higher-paying lanes

Remote Pay Nuance

Employers use two main models:

- Geo-differentiated pay → Salary based on employee location. Same role = different pay depending on state.

- National pay band → One range for all applicants, regardless of location.

Tips:

- Read postings for terms like “geographically differentiated pay,” “market-based pay,” or “national band.”

- If relocating, ask:

- Does pay adjust when you move?

- How often are geo tiers recalibrated?

Example State Snapshots (Approximate)

Ranges below reflect typical W2 compensation for experienced, certified coders (CPC/CCS; 2–5+ years), non-management. Specialty mix, productivity, and auditing duties can shift salaries above or below.

Note: Estimates reflect blended patterns from BLS, AAPC surveys, and job postings through 2024. Always validate current-year ranges for 2025.

| State / Region (Metro) | Typical W2 Annual | Typical W2 Hourly | Why pay trends higher/lower | Remote notes |

| California (Bay Area, LA, SD) | $62k–$85k+ | $30–$40+ | High COL, academic centers, complex cases, union presence in some systems | Many national employers pay location-based; CA candidates often top band |

| New York (NYC/Long Island) | $58k–$80k | $28–$38 | High payer complexity, large hospital networks, specialty groups | HQ-based pay can help if employer located in NYC |

| Massachusetts (Boston) | $58k–$78k | $28–$37 | Academic medical centers, research hospitals, strong CDI/coding integration | Auditor/educator roles often present; hybrid common |

| Washington (Seattle) | $56k–$76k | $27–$36 | Integrated health systems, tech-driven RCM vendors | Remote demand steady; some employers use WA as high-cost tier |

| DC / Maryland / Virginia (DMV) | $58k–$80k | $28–$38 | Federal systems, large academic centers, payer HQs | Plenty of auditing, compliance, and policy-adjacent roles |

| Colorado (Denver) | $55k–$74k | $26–$35 | Growing hospital networks and specialty practices | Some national firms peg CO as mid-to-high cost tier |

| Texas (Dallas, Houston, Austin) | $50k–$70k | $24–$34 | Large employer density, strong MA penetration (HCC work) | Seasonal risk-adjustment contracts can spike hourly rates |

| Florida (Miami, Tampa, Orlando) | $48k–$66k | $23–$32 | Heavy Medicare Advantage; high demand for HCC coders | Plenty of remote vendors; verify 1099 vs W2 benefits |

| Illinois (Chicago) | $52k–$72k | $25–$34 | Academic systems, large multi-specialty groups | Commuter areas offer hybrid with city-level pay |

| North Carolina (RTP, Charlotte) | $50k–$68k | $24–$33 | Growing hospital systems; strong outpatient and pro-fee volume | Good entry-to-mid remote options after 6–12 months experience |

| Lower-COL examples (AL, MS, OK, WV, AR, SD, NM) | $42k–$62k | $20–$30 | Fewer large systems; lower base but lower living costs | Remote national roles can outpay local averages |

How to Research Medical Coding Salaries in Your State

If you want real numbers, not just national averages, here’s a simple “homework plan” to figure out what coders earn where you live:

1. Start with Official Data

- BLS (Bureau of Labor Statistics): Pull the Occupational Employment and Wage Statistics for “Medical Records Specialists” by state and metro. Note the median and 75th percentile wages.

2. Cross-Check with Industry Surveys

- AAPC Salary Survey: Filter by your credentials, work setting, and state. This gives a closer look at coder-specific pay.

3. Look at Real Job Postings

- Scan Indeed, LinkedIn, and hospital system job boards. Search your certification + title (e.g., CPC, CCS) and save 10–15 listings. From there, compute a quick median pay range.

4. Tap Local Insights

- Ask your local AAPC or AHIMA chapter leaders. They’ll know which employers are paying above market in your state or city.

5. Adjust for Cost of Living (COL)

- Use this quick sanity check formula:

Target salary in State B ≈ Current offer in State A × (COL index of B ÷ COL index of A).

6. For Remote Roles, Ask Directly

- Does the company pay based on your location or a national pay band?

- If geo-based: What’s the differential for my ZIP code?

- Clarify how productivity and quality bonuses are calculated remotely.

Quick Ways to Boost Your State-Based Earnings

- Stack the right credentials: Choose the certifications your state’s employers prize most (e.g., CCS in hospital-heavy states; CRC in Medicare Advantage-heavy states).

- Specialize in high-value niches: Inpatient DRG validation, interventional radiology, cardiology, anesthesia, or HCC auditing pay more.

- Track and share your metrics: Employers love data, charts per hour, accuracy rates, and denial reductions travel across state lines and beat “average coder” profiles.

Role-by-Role: What Each Path Pays in 2025

Here’s how medical coding roles typically stack up in 2025. Ranges reflect US W2 base pay and common 1099 contract rates. Actual offers will shift based on your certifications, state/metro, remote policy, and productivity/QA metrics.

| Role | Core focus | Common certs | W2 annual (typ.) | W2 hourly (typ.) | 1099 rates (guidance) |

| Medical coding specialist | Outpatient/pro-fee, multi-specialty, heavy E/M and minor procedures | CPC, COC; add CDEO for education track | $48,000–$72,000 | $23–$35/hr | $30–$48/hr |

| Inpatient facility coder | DRG assignment, PCS, CDI collaboration, high complexity | CCS, CIC; RHIT/RHIA helpful for advancement | $65,000–$92,000 | $31–$44/hr | $40–$60/hr |

| Risk adjustment coder (HCC) | MA/ACA HCC capture, retrospective/prospective reviews | CRC; CPC/CCS + HCC experience is gold | $58,000–$85,000 | $28–$40/hr | $32–$55/hr or $3–$7/chart (project) |

| Coding auditor and educator | Pre/post-bill audits, education, risk mitigation | CPMA, CDEO; CCS/CIC for facility auditing | $75,000–$105,000 | $36–$50/hr | $50–$85/hr |

| Medical biller / revenue cycle specialist | Claims, edits, denials, appeals, cash posting, AR | CPB; CRCR or payer-specific trainings help | $42,000–$62,000 | $20–$30/hr | $28–$45/hr |

| Team lead / supervisor / manager | People leadership, KPI ownership, cross-functional ops | RHIT/RHIA; CCS/CPC stack; PMP or Lean is a plus | $80,000–$120,000+ | $38–$58/hr | $60–$120/hr (consulting) |

Note: Higher-cost metros and health systems sit at the top of bands. Multi-cert stacks, niche specialties, and off-shift coverage can widen ranges.

Medical Coding Specialist Salary in 2025

Medical Coding Specialists earn based on two things: speed and accuracy. Employers pay more when you can process a steady volume of charts per day while maintaining 95–98% QA accuracy. Staying current on 2023–2025 E/M guidelines, NCCI edits, and payer-specific quirks shows you can handle complexity without costly errors.

Quick salary levers: add a surgical specialty module, earn a CDEO credential, or volunteer as a peer reviewer. Small, targeted steps like these can add up quickly during annual salary reviews.

Inpatient Facility Coder Salary

If you’re coding on the facility side, DRG accuracy equals revenue. Employers reward coders who can capture CC/MCC correctly and partner with CDI teams to minimize denials. Credentials like CCS or CIC typically push you into the higher pay band.

Pro tip: night and weekend shifts, as well as trauma or teaching hospital settings, often come with differentials. If you thrive in complex environments, this lane consistently pays more.

Risk Adjustment Coder (HCC) Salary

Risk adjustment is seasonal but highly lucrative. With a CRC credential and strong MEAT documentation review skills, coders can command top rates, especially in Q3–Q4 when Medicare Advantage projects spike.

If you’re paid per chart, track your case complexity and QA acceptance rates. Always negotiate for tiered pay when handling multi-source reviews or E/M-heavy encounters—it can make a big difference in effective hourly pay.

Coding Auditor and Educator Salary

Coders in auditing or educator roles are the fixers and coaches of the revenue cycle. With CPMA or CDEO credentials, plus facility-side depth (CCS or CIC), you can step into enterprise-level positions.

Employers pay premiums when you can reduce denial risk, standardize provider documentation, and raise coder QA rates. The more you document those wins, the more negotiating power you’ll have.

Medical Biller and Revenue Cycle Specialist Salary

For billers and RCM specialists, compensation ties directly to cash flow metrics. Show that you can reduce days in AR, increase first-pass claim yield, and overturn more appeals, and you’ll move toward the top of the pay range.

With a CPB credential, payer portal fluency, and strong appeal-writing skills, you can stand out quickly. Some coders find success blending roles, working both billing and denial prevention, for faster raises.

Team Lead, Supervisor, and Manager Salary

As you move into leadership, pay is shaped by your scope of responsibility, FTE headcount, number of service lines, and key performance indicators. An RHIT or RHIA credential helps open these doors.

Edge cases that often lift salaries include overseeing multi-site operations, driving Epic or Cerner optimization projects, and leading measurable denial reduction initiatives across entire service lines.

Helpful Rule of Thumb

- Expect 5–15% higher pay when you stack advanced credentials that match your lane (e.g., CPC → CPC + CRC, or CCA → CCS).

- Remote roles may tie pay to employer HQ or your home address, clarify early in the process.

- Bring hard data to the table when negotiating: charts/day, QA accuracy, denial reduction impact, DRG validation accuracy, and training results. Numbers travel better than titles alone.

Education and credential pathways (with prep resources)

Pick a lane, book a date, build a rhythm. That’s the formula. Use the map below to choose your first credential and your next move.

| Path | First credential | Typical prep time | Core study focus | Entry roles | Next stack |

| Outpatient/pro-fee starter | CPC (AAPC) | 8–16 weeks with steady practice | ICD-10-CM, CPT, HCPCS, E/M 2023+ rules, NCCI edits | Outpatient coder, multi-specialty clinic coder | CRC for HCC or CPMA for auditing depth |

| Hospital/inpatient track | CCA (AHIMA) → CCS | CCA: 6–12 weeks; CCS: 3–6 months after real cases | ICD-10-CM/PCS, DRG logic, UHDDS, compliance | Inpatient/outpatient facility coder, DRG reviewer | CIC (inpatient) or auditing credentials |

| Billing-first / RCM | CPB (AAPC) | 6–12 weeks | Claims lifecycle, payer rules, denials, AR workflows | Medical biller, revenue cycle specialist | CPMA (auditing) or CPCO (compliance) |

| Leadership / HIM | RHIT (associate) → RHIA (bachelor’s) | Degree programs (2–4 years); exam prep ~6–12 weeks | HIM operations, data governance, privacy, revenue integrity | Lead coder, HIM analyst, supervisor | Add CCS or CPMA to widen scope |

Choosing Your Starting Lane in Medical Coding or Billing

If you’re brand new and want to get into the field quickly, the best move is to pick the credential that lines up with the type of work you’re aiming for:

- Outpatient / Pro-Fee Track: Go for the CPC. It’s the most widely recognized entry-level coding certification, gives you broad exposure, and pairs especially well with E/M-heavy roles in physician practices and clinics.

- Hospital / Inpatient Track: Start with the CCA, then step up to the CCS once you’ve gained real-world inpatient chart experience. The CCS is more advanced, it expects comfort with ICD-10-PCS and a solid understanding of DRG assignment.

- Leadership Path: If you’re thinking long-term and want to move into management, compliance, or policy, the RHIT (associate degree) is a solid foundation. With a bachelor’s, the RHIA opens doors to leadership and HIM operations.

- Billing First Approach: If coding feels too clinical at the start, you can enter through billing with the CPB. This role focuses on payer policy, edits, and cash flow. From there, you can add CPMA (auditing) or CPCO (compliance) to become a go-to expert on risk and rules.

👉 Quick nuance:

- CCS is tough. Many employers prefer candidates with at least 1–2 years of inpatient coding before taking it.

- CPC builds momentum faster. Add the CRC if risk adjustment and diagnosis depth (HCC capture, MEAT criteria) interest you.

How to Build a Study Plan That Actually Works

Consistency beats cramming. A structured, focused plan will carry you farther than trying to juggle too many resources:

- Pick one main course or syllabus. Stick to it, don’t overwhelm yourself with multiple curricula.

- Daily practice: Aim for 60–90 minutes of targeted practice questions plus 15 minutes of guideline review.

- Study order that makes sense:

- Guidelines first (ICD-10-CM chapter rules, CPT section notes, HCPCS conventions).

- Core cases (E/M coding, minor procedures, imaging, injections/infusions).

- Specialty drills (ortho, cardio, GI, OB/GYN, or your chosen niche).

- Edits & bundling (NCCI, MUEs, and modifiers like 25, 59/XS, 51, 24, 57).

- Practice with light labs: Watch short EHR chart demos (YouTube or vendor sandboxes). Practice pulling diagnoses and procedures into codes and create your own “abstracting checklist.”

- Final 2–3 weeks (exam mode):

- Take one timed, full-length mock each week.

- After each, tag your misses by guideline, code set, or specialty, then re-drill only those weak spots.

- Build “speed sheets”, one-page quick references for modifiers, common excludes notes, DRG pitfalls, and E/M decision-making.

This way, you’re not just memorizing, you’re training yourself to think like a working coder or biller, which also happens to make exam day much less stressful.

| Sprint | Focus | Daily target | Output |

| Weeks 1–2 | Guidelines deep dive | 40–60 Qs/day + 20 min notes | Guideline flashcards; code book tabs |

| Weeks 3–4 | Core cases + edits | 60–80 Qs/day (mixed CPT/ICD-10-CM) | Modifier and NCCI “speed sheet” |

| Weeks 5–6 | Specialty drills (your lane) | 2 mini-mocks/week, timed | Error log with rationales |

| Weeks 7–8 | Full mocks + refinement | 1 full mock/week + review day | Exam-day plan, pacing strategy |

Practice Question Resources

The fastest way to build coding speed and decision flow is by working through timed practice sets. Use a blend of third-party drills and official AAPC/AHIMA practice exams so you’re aligned with the test format.

- CPC Practice Set: CPC PDF Exam Questions

- RHIA Practice Set: RHIA PDF Exam Questions

- NRCMA Practice Set (adjacent role): NRCMA Exam Questions

- SPI Practice Set (adjacent role): SPI PDF Questions

Pro Tip: Don’t just memorize the right answers. Study the why behind each one. Tag every rationale to its source, like a CPT parenthetical note or an ICD-10-CM excludes 1 rule, so the reasoning sticks for the long term.

How to Maximize ROI From Your Certification?

Pairing one credential with one measurable skill gives hiring managers a clear reason to pay you more. On your resume and in interviews, frame your skills as before-and-after impact statements.

- CPC + “Improved E/M scoring accuracy from 88% to 95% in 60 days.”

- CCA → CCS + “Validated DRGs with <2% variance against auditor reviews.”

- CPB + “Reduced first-pass denials by 10% with modifier and medical necessity checks.”

- RHIT → RHIA + “Led weekly coding quality huddles, tracked KPIs, and closed documentation gaps.”

Keep a wins log, track your metrics, de-identified case examples, and playbooks. These receipts are gold during performance reviews and salary negotiations.

Essentials Checklist for Exam Prep

Make sure you’re fully geared up before test day:

- Current ICD-10-CM, CPT, and HCPCS Level II (2025 editions)

- A guidelines binder or digital notes with color tabs for quick reference

- One reliable encoder/practice tool and a timer for drills

- A mock exam schedule locked into your calendar

- Official exam date booked early, let the countdown keep you motivated

Skills That Raise Your Medical Coding Salary Quickly

If you want a faster bump in your pay, focus on skills that move revenue, reduce risk, or boost productivity. The formula is simple: pick one lane, produce results, track the metric, then stack the next skill.

1. Coding Depth

Being precise and fast in coding is one of the clearest paths to higher pay.

Key Areas to Master:

- E/M Guidelines (2021+) – Understand document leveling, MDM nuance, time-based rules, and split/shared visits.

- Surgical Coding – Get sharp with modifiers (24, 25, 57, 59/XE/XS/XP/XU, 51, 58 vs 78 vs 79), global period logic, add-on codes, and device-dependent codes.

- DRG/APC Drivers – Learn CC/MCC capture, principal diagnosis selection, POA indicators, packaging, and composite APCs.

- Edit Logic – Don’t just accept NCCI or payer edit flags; read the rationale and fix upstream.

Quick Wins:

- Build a “modifier decision map” for your top two specialties. Apply it to 50 recent claims and track denial reduction.

- Create a one-page DRG/APC cheat sheet for high-volume service lines (cardio, GI, ortho) and share with your team.

Proof to Show:

“Reduced surgery bundling denials from 12% to 4% over 6 weeks by correcting 59→XS use and sequencing.”

2. Risk Adjustment

Risk adjustment (HCC coding) is in high demand, and accuracy here directly impacts payer revenue.

Key Areas to Master:

- HCC Mapping Accuracy – Get specific with conditions (e.g., diabetes with complications, CKD staging, HF type/class).

- MEAT/IER Standards – Show Monitoring, Evaluation, Assessment, and Treatment in notes without cloning or upcoding.

- Retrospective vs Prospective Reviews – Close documentation gaps pre-visit; validate suspect lists with clinical nudges.

- RAF Literacy – Understand how specificity, persistence, and recapture affect revenue and coder value.

Quick Win:

- Build a 15-condition HCC checklist with ICD-10-CM specificity prompts (stage, laterality, acuity) and use it on your next 200 charts.

Proof to Show:

“Improved HCC capture accuracy from 87% to 96% and raised average RAF per eligible member by 0.08 in Q2.”

3. Revenue Cycle

Billers and coders who prevent denials and recover revenue stand out fast.

Key Areas to Master:

- Denial Prevention & Appeals – Read CARC/RARC codes, tie appeals to LCDs/NCDs, and attach strong medical necessity notes.

- Timely Filing & Payer Portals – Learn flows on Availity, NaviNet, and payer-specific portals to prevent avoidable write-offs.

- Root-Cause Fixes – Address recurring issues like POS mismatches, missing ABNs, C-codes, or taxonomy/NPI errors.

Quick Win:

- Build a “Top 10 Denials → Fix” matrix for your clinic. Implement two pre-bill checks to stop the most frequent denials.

Proof to Show:

“Recovered $68k in 60 days by standardizing appeals for 96372 bundling and adding LCD references.”

4. Quality and Productivity

The more clean charts you code with accuracy, the more leverage you have.

Key Areas to Master:

- Benchmark Yourself – Track charts per hour by specialty and QA pass rate.

- Tight Feedback Loop – Review every audit note, log recurring errors, and set one micro-goal each week.

- Show Before-and-After Deltas – Hiring managers love seeing measurable improvement.

Quick Win:

- Create a simple dashboard with chart counts, errors, and trends by specialty. Focus on improvement, not perfection.

Proof to Show:

“OP pro-fee: 16→25 clean charts/hour in 45 days at 97.8% QA.

5. Tooling Fluency

Tech-savvy coders and billers get paid more because they save time and prevent errors.

Key Areas to Master:

- Encoders/EHRs – Learn shortcuts and quirks in 3M, Optum, TruCode, Epic, Cerner, and Athena.

- Claim Scrubbers – Customize edits to prevent frequent misses and align with payer policies.

- Data Basics – Use Excel pivots, XLOOKUP, COUNTIFS, or even simple SQL queries to spot error trends and denial patterns.

Quick Win:

- Build a pivot table ranking your top denials by dollar amount and payer. Implement two pre-bill rules to address them.

Proof to Show:

“Cut rework 22% by adding three scrubber rules and an Excel pre-bill check.”

Bottom line: Pick one lane, demonstrate results with before-and-after metrics, and use that proof to push for higher pay. Then stack the next skill to keep climbing.

| Skill focus | What to master (keywords) | 1–2 week quick win | Proof/metric to show | Who values it |

| Coding depth | E/M MDM & time; surgical modifiers 24/25/57/59-X{E,S,P,U}; NCCI/MUE; DRG/APC; POA; status indicators | Create a modifier decision map; rework last 50 denials with root-cause notes | Denial rate ↓; clean claim rate ↑; DRG accuracy ↑ | Hospitals, multi-specialty groups, surgical centers |

| Risk adjustment (HCC) | HCC v28 mapping; MEAT/IER; chronic condition specificity; RAF basics | Build a 15-condition checklist; run prospective prompts for next clinic day | HCC accuracy ↑; RAF per eligible member ↑; query acceptance rate ↑ | MA plans, risk vendors, primary care networks |

| Revenue cycle | CARC/RARC decoding; LCD/NCD citation; timely filing; payer portals; ABN | Top-10 denial matrix; add two pre-bill scrubber rules | AR days ↓; recoveries ↑; appeal overturn rate ↑ | Physician groups, RCM vendors, payers |

| Quality & productivity | Charts/hour by specialty; QA pass rate; error taxonomy; feedback loops | Personal KPI dashboard with weekly micro-goal | Charts/hour ↑ with QA ≥ 95–98%; rework ↓ | Any employer with productivity KPIs (most) |

| Tooling fluency | 3M/TruCode/Optum; Epic/Cerner; scrubbers; Excel pivots/XLOOKUP; basic SQL | Build a pivot to rank denial dollars by payer and CPT; set alerts | Throughput ↑; touchpoints per claim ↓; automation saves minutes/chart | Hospitals, vendors, data-driven teams |

Which Coding Certification Pays the Highest Salary?

Among coding credentials, the Certified Professional Coder (CPC) and the Certified Coding Specialist (CCS) are often linked with the highest salaries. These certifications demonstrate advanced skills in medical coding, compliance, and reimbursement, which makes professionals more valuable to employers. Pay also varies by location and experience, but holding one of these certifications usually places coders in the top earning range.

How to Turn Skill Into Salary Fast?

Getting better at coding or billing is only half the battle, the other half is proving your impact in a way that hiring managers can’t ignore. Here’s how to do it:

1. Document Your Wins Weekly

Keep a simple log with:

- Date

- Specialty or project

- Action you took

- Metric change (before → after)

Make sure all entries are de-identified to protect PHI. Over time, this log becomes your personal portfolio of impact.

2. Translate Wins Into Interview Lines

Turn raw metrics into tight one-liners you can use in conversations:

- “I raised clean claims from 86% to 94% in ortho by fixing modifier logic and adding two scrubber checks.”

- “During HCC season, I averaged 32 reviewed charts/hour at 98.5% QA.”

Clear numbers + clear action = instant credibility.

3. Package It on Resume and LinkedIn

The order matters:

- Numbers first – show measurable results.

- Tools second – encoder, EHR, scrubber, analytics.

- Credentials third – CPC, RHIA, CCS, etc.

That sequence signals you’re not just certified, you deliver outcomes.

4. Ask for the Differential

When it’s time to negotiate:

- Present the before/after metric.

- Tie it directly to revenue, quality, or risk reduction.

- Then state your salary range with confidence.

Hiring teams pay more when they see clear ROI.

Bottom line: Track the wins, speak the numbers, show the tools, and claim the raise.

Remote, Contract, and Seasonal Roles: What to Expect in 2025

Not all medical coding jobs look the same. Beyond traditional in-office W2 roles, you’ll see more remote, 1099 contracting, and seasonal project work in 2025. Each comes with its own pay model, risks, and advantages.

| Arrangement | Pay structure | Benefits | Overhead/taxes | Schedule control | Productivity expectations | Best for | Watch outs |

| Remote W2 | Hourly or salary; geo-based or geo-neutral pay | Health, PTO, retirement match, CEU funds (varies) | Employer handles taxes; minimal personal overhead | Moderate—core hours, meetings, QA windows | Charts/day, accuracy/QA%, TAT, denial/appeal impact | Stability + benefits; long-term growth | Location-based pay; equipment policies; non-competes |

| Hybrid W2 | Hourly or salary; often same as remote W2 | Same as W2; may include commuter stipends | Employer taxes; small commute/equipment costs | Lower on remote days, fixed on onsite days | Similar KPIs; onsite collaboration boosts QA | Mentorship, new grads, leadership tracks | Commute; office days may vary during audits/go-lives |

| 1099 contract | Hourly or per-chart; typically higher base rate | None; you buy your own | Self-employment tax; CEUs, device, insurance, tools | High—set your blocks, hit deliverables | Strict floors: charts/hour, QA thresholds, TAT | Speed + accuracy pros; side gigs; short bursts | No benefits; variable volume; net-30/45 payment terms |

| Seasonal/project | Per-chart, per-record, or short-term hourly | Usually none (contract) | Same as 1099; ramp time unpaid | Very high—deliver by milestone | Volume spikes; tight QA gates | HCC season, backlogs, EHR conversions | Seasonality; SOW scope creep; variable QA feedback |

Remote W2 Roles

- Pay structure: Some employers tie pay to your home ZIP code; others use a single national pay band. Ask early: “Is compensation based on employee location or employer HQ?”

- Performance metrics: Remote pay and raises follow hard data, charts/day, QA rates, DRG/APC accuracy, denial prevention, appeal success, and turnaround times. Build your own mini dashboard to stay ahead.

- Tools & setup: Expect company-issued laptops, VPN, MFA, and encoder licenses. Clarify whether they cover internet stipends, headsets, or dual monitors.

- Schedules & OT: Usually a mix of core meeting hours and flexible heads-down coding time. Check overtime rules (pre-approval, holiday pay, bonus tiers).

- Pro tip: Log weekly wins like “X charts/day at Y% QA, Z denials prevented”, those notes become your ammo for reviews and raises.

1099 Contracting

- Higher rates, fewer benefits: Contract work typically pays more per hour but you cover your own health insurance, retirement, CEUs, and downtime. Always set aside money for taxes and expenses.

- Business mindset: Handle quarterly tax estimates, liability insurance, device security, and CEU budgets. Track write-offs (internet, gear, dues).

- Read the fine print (SOW): Look for minimum volume guarantees, QA thresholds, turnaround times, device policies, and payment terms.

- Negotiation tip: Suggest a short trial (20–40 hours) at your target rate tied to QA ≥ a stated benchmark.

Seasonal Projects

- Where they show up: Medicare Advantage HCC reviews (peaking late summer through early spring), backlog cleanups, payer audits, and EHR/vendor conversions.

- Why they work: Quick way to build specialty depth, test your true speed, and see your market value, without quitting your W2.

- Stay ready: Keep credentials active, register with 2–3 reputable vendors, and track your per-chart QA and throughput.

- Quick math check:

Effective hourly = (pay per chart × charts/hour).

Example: $3.50/chart × 10 charts/hour at 95% QA = $35/hour before expenses.

Compliance Basics

- PHI first: Always use encrypted, employer-approved devices with VPN and MFA. No personal printing unless policy allows, and always shred securely.

- Secure workspace: Private room, lock screen, no smart speakers. Keep Wi-Fi updated (WPA3 if possible) and devices patched.

- Audit readiness: Code straight from the note, follow query policy, and leave a clean trail. QA reviews and access audits are part of the deal, treat them as currency, not punishment.

Smart Comparisons in Minutes

- Salary ⇄ hourly: Hourly ≈ Annual ÷ 2080.

- Factor benefits: A 1099 contract might look richer, but weigh it against lost health/retirement benefits and out-of-pocket costs.

- Piece-rate sense check: Track your average charts/hour and QA for a week. Use the average, not your best day.

Micro-Moves to Boost Take-Home

- Ask upfront about geo pay policy and productivity bonus ladders.

- For 1099, negotiate paid ramp-up hours when workflows are complex.

- Keep your KPI log current, it doubles as your promotion packet.

Bottom line: W2 remote jobs bring stability and benefits, 1099 contracts deliver raw pay, and seasonal projects offer fast experience. The best choice depends on your career stage, appetite for risk, and how much admin work you’re willing to take on.

| Component | What it is | Typical in 2025 (coding/billing) | Why it matters |

| Base pay | Your annual salary or hourly rate (W2). | Entries to senior bands vary by certs, setting, specialty, and state. | Set your floor. Everything else stacks on top. |

| Annual bonus | Performance or company bonus paid yearly or quarterly. | 0–10% of base is common; tied to productivity/quality KPIs. | Turns strong metrics into real cash. Ask for the formula. |

| PTO + holidays | Paid time off plus observed holidays. | 15–25 PTO days + 6–10 holidays is typical; PRN/1099 usually none. | Value it at your daily rate; more days = higher effective pay. |

| Retirement match (401k/403b) | The employer matches a slice of your contributions. | Common: 3–6% match; vesting may apply. | Free money. Increases long-term comp without taxes now (pre-tax plans). |

| Health benefits | Medical, dental, vision; HSA/FSA options. | Employers pay a portion of premium; HSAs sometimes seeded $250–$1,000/yr. | Premium support can equal several thousand per year. |

| CEU reimbursement | Budget to maintain certifications. | $200–$1,000/yr, plus conference days at some employers. | Keep your credentials active without out-of-pocket costs. |

| Certification coverage | Exam fees, study materials, and retake support. | 1 exam/yr covered; some include paid study time. | Direct career lift. Ask if coverage extends to advanced certs. |

| Remote stipend + equipment | Monthly internet/phone stipend; employer-supplied hardware. | $30–$100/mo; laptop and dual monitors commonly provided. | Offsets home office costs; protects your take-home. |

| Productivity/quality bonuses | Extra pay for charts/hour, accuracy, denial wins, or clean claims. | Monthly or quarterly payouts; varies by metric and role. | If you’re fast and precise, this adds up quickly. |

| Shift differentials | Premiums for evenings, nights, weekends, holidays. | +5%–20% per hour depending on shift and employer. | Smart way to lift pay without changing roles. |

| Tuition assistance | Employer-funded courses or degrees (HIM, data, leadership). | $2,000–$5,250/yr common; sometimes higher in hospital systems. | Compounds your future earning power. |

| Leave & insurance | Parental leave, STD/LTD, life insurance, EAP, commuter benefits. | Varies widely by employer; hospitals often offer richer packages. | Reduces risk and out-of-pocket surprises. |

What to Weigh Beyond Base Pay

When comparing offers, don’t stop at the salary line. A $2,000 higher base can shrink fast once you factor in benefits, or lack of them. Here’s how to think like a coder running the math.

The Big Five

Start with the essentials most employers put real money into:

- Base pay – your starting line.

- Bonus – annual or quarterly, tied to performance.

- PTO – vacation, sick, holidays; multiply days × your daily rate.

- Retirement match – 401(k) or 403(b) matches compound big over time.

- Health coverage – premiums, deductibles, and employer contributions all matter.

The Perks That Add Up

- Work style: Remote/hybrid flexibility, shift differentials, and OT eligibility can be worth thousands.

- CEUs and exams: If they pay for CEUs, renewals, or exam attempts, that’s direct cash you keep.

- Gear and stipends: Paid internet, dual monitors, or ergonomic gear preserve your net pay.

- Study time: Some employers cover work hours for prep or give a second paid exam attempt, that’s hidden gold.

Example: Comparing Two Offers

- Offer A: $58,000 base + 5% bonus target ($2,900) + 20 PTO days (≈$4,460) + 4% 401k match ($2,320) + $300 CEU + $600 stipend.

Estimated total value: ≈ $68,280. - Offer B: $62,000 base, no bonus, 12 PTO days (≈$2,860), no match, no CEU, no stipend.

Estimated total value: ≈ $64,860.

Lesson: A slightly lower base can outpace a higher one once benefits stack. Always run the math.

Career Compounding

The real long game is growth. Employers that invest in credentials, tuition, and cross-training give you more than just cash, they accelerate your salary curve. One year of CCS or CPMA prep on the company dime can out-earn a “higher base, no support” path within two years.

Ask about career ladders (coder → senior → auditor/educator → lead). Clear paths make raises predictable.

How to Evaluate an Offer Fast

- Request the benefits guide in writing.

- Confirm eligibility dates (some perks kick in after 30–90 days).

- Ask for the bonus plan rules and past payout history.

- Verify remote/geo-pay policy and what gear they provide.

- For hourly W2: clarify OT, holiday, and differential rates.

- For 1099: confirm scope, QA targets, minimum hours, and payment terms.

Bottom line: Optimize for total life value, cash + growth + flexibility—not just the base salary number.

Where to pull the latest salary data

Use these sources to triangulate 2025 pay fast. Bookmark, skim, and save screenshots with dates so your numbers hold up in negotiations.

| Source | Best for | Update cadence | Useful filters/tips | Direct link |

|---|---|---|---|---|

| Bureau of Labor Statistics (Medical Records Specialists) | National and state baselines, metro pay, percentiles | Annual (OOH) + periodic OEWS updates | Pull state tables; open “Metropolitan areas” view; note median vs 90th percentile | BLS OOH page |

| AAPC salary and job market research | Certification impact (CPC, CRC, CPMA, etc.), remote vs onsite, specialty deltas | Annual survey | Filter by cert stack, region, years of experience; check remote breakdowns | AAPC Research hub |

| AHIMA workforce and salary insights | Hospital-centric roles, RHIT/RHIA tracks, leadership bands | Periodic studies + career resources | Scan for inpatient vs outpatient splits; look for DRG/auditing roles | AHIMA Career resources |

| Job boards with posted ranges | Real-time market rates by state, specialty, and employment type | Daily | Filter “medical coder,” “inpatient coder,” “risk adjustment,” W2 vs 1099, remote-only; save alerts | LinkedIn, Indeed, ZipRecruiter, AAPC Jobs, AHIMA Career Center |

Bureau of Labor Statistics (Medical Records Specialists overview)

Clean, fast steps to pull BLS and market data and use it correctly when you price yourself or compare offers.

How to pull BLS in 60 seconds

- Open the Occupational Outlook Handbook page for Medical Records Specialists and jump to the Pay section.

- Click through state and metro tables (if available) and note median and 10th/90th percentiles, this gives an entry → expert bracket.

- Grab state/metro names that match where you’re job-hunting (or where your employer-of-record hires).

Read it right: BLS groups coders, billers, and HIM techs together. Treat it as a conservative baseline for coding/billing pay and use percentiles to estimate junior vs senior vs specialized roles. Always pair BLS numbers with cert-specific sources (AAPC/AHIMA).

AAPC: salary & job-market research (what to pull)

- Quick path: open the latest AAPC salary survey; filter by certification (CPC, CRC, CPMA, CIC/COC), experience, region, and remote status.

- Note deltas for multi-cert stacks and productivity/bonus patterns.

- Why it helps: data is self-reported by working coders; excellent for credential-specific tasks (e.g., “CPC + CRC in the Midwest”).

AHIMA: workforce & hospital-focused insights

- Pull salary snapshots for hospital roles, DRG coders, auditors, and leadership (RHIT/RHIA).

- Look for trend notes on inpatient complexity, CDI collaboration, and remote adoption.

- Tip: AHIMA often mirrors hospital HR bands more closely than general market sites,use it if you target facility coding.

Job boards with posted ranges (fast scan)

- Where to look: LinkedIn Jobs, Indeed, ZipRecruiter, Glassdoor, AAPC Jobs, AHIMA Career Center, and hospital system career pages.

- Filters that save time: title (inpatient coder, risk adjustment coder, coding auditor, revenue cycle specialist), location + “remote,” employment type (W2 vs contract).

- Skim for: whether ranges are base-only or total cash, any productivity/quality bonus, shift differential, and remote stipend.

How to Sanity-Check the market data (step-by-step)

- Cross-verify sources: pull one number from BLS and one from AAPC/AHIMA and compare.

- Check live postings: review 3–5 current job ads in your target state/specialty and compute a quick median.

- Normalize units: convert annual ↔ hourly with 2,080 hours/year. Add benefit value for W2; subtract expected self-funded costs for 1099.

- Adjust for location/remote policy: confirm whether the employer pays by employee location or HQ/national band before comparing.

- Tie to performance: align your target to measurable outputs (charts/hour, QA accuracy, denial/appeal impact) to justify the top of the band.

Quick conversion helper (examples)

| Hourly | Annual (x 2,080 hrs) | Note |

|---|---|---|

| $25 | $52,000 | Baseline junior-mid W2 roles in many regions |

| $35 | $72,800 | Experienced/specialty or high-COL metros |

| $45 | $93,600 | Auditing, inpatient, or 1099 project spikes |

Mini-checklist you can reuse

- Confirm the year on every source (2024 vs 2025 labeling).

- Save the PDF or page link with date.

- Build a simple average from 2–3 sources; set your ask at the top third if you have strong metrics or advanced certs.

- Negotiating your medical billing and coding salary <–Negotiation is a project. Bring proof. Bring market comps. Offer options, not ultimatums. Calm tone. Clear math.

Prep: gather your market & evidence kit

- Collect ranges by state, metro, role, and certification (BLS, AAPC, AHIMA + 3–5 live job posts with posted pay).

- Build a one-page metrics pack showing productivity and quality with role context (outpatient, inpatient, HCC, billing).

- Tag your certification stack and recency (CPC/CCS/CRC/CPMA/RHIT/RHIA; year earned; CEUs current).

- Line up 2–3 value stories (reduced edits, boosted first-pass yields, overturned denials, improved DRG/APC or HCC capture).

- Know your floor, target, and two non-cash asks before you start conversations.

Levers: what you can pull (and how they show up)

Pay levers

- Base pay / hourly rate

- Sign-on or retention bonus

- Shift differentials (evening/weekend/holiday premiums)

- Productivity/quality bonuses tied to KPIs

Role design levers

- Remote vs hybrid schedule; W2 vs 1099 structure

- Specialty mix (add surgery, IR, cardiology, anesthesia, HCC seasons)

- Project work (backlogs, DRG validation, audits) often with premium rates

Growth levers

- Certification differentials (CPC, CCS, CRC, CPMA, RHIT/RHIA)

- CEU budget, exam fees, paid study time or paid exam retake

- QA mentoring time, educator track, and cross-training opportunities

Phrases that work (plug-and-play negotiation lines)

- “Based on BLS/AAPC ranges for [state/metro] and my role, plus my current output of [X charts/day] at [Y%] QA, I’m targeting [A–B] for base.”

- “With [Z certification] and recent [DRG/APC/HCC] results, a move to [A–B] aligns with market and impact.”

- “If base can’t reach [target], would you consider [shift differential + quarterly productivity bonus] to close the gap?”

- “I can take on [denial-reduction initiative/QA mentoring] in the first 60 days. With that scope, [A–B] is reasonable.”

- “Your posted range tops at [X]. With my metrics, can we land near the top and add a 6-month review pegged to [quality/productivity]?”

If budget is firm: smart non-cash asks

- CEU funds, exam fees, paid study time, or a certification differential on pass date

- Remote stipend, upgraded equipment, or paid hours for exam prep

- A written 6-month review tied to clear KPI targets and a salary figure

- Trade scope for immediate value: weekend block, HCC season, or a mini-audit for a stipend

- Clarify when ranges are reviewed (fiscal year / market cycle) and put it in writing

Quick math & negotiation cheats

- $1/hour ≈ $2,080/year (FT W2)

- 5% bonus on $60,000 = $3,000

- 1 PTO day value ≈ base / 260 workdays

- CEU/exam coverage can offset hundreds → thousands annually

- A 2% productivity lift at scale can justify top-of-range placement—bring a plan and the timeline

Delivery tips: how to pitch it

- Keep it short. Lead with data, then ask.

- One ask at a time. Make the ask, then pause.

- Friendly, curious tone. Negotiate as a collaborator, not an adversary.

- Close with action: “Can we align on [target] or lock [alternative + 6-month review] today?”

Career ladders & side paths

Core ladder: Coder → Senior Coder → Auditor/Educator → Lead → Manager → Director.

Side paths (what they pay you back):

- CDI Specialist: bridge clinical → coding. Skills: MEAT, DRG impact. Certs: CCS, CDIP/CCDS.

- Revenue Integrity Analyst: charge capture, modifiers, CDM. Strong Excel + payer policy fluency.

- Payer Policy Analyst: map NCD/LCD and commercial rules to front-end edits.

- Compliance: CPMA + policy writing and audit program experience.

Education & skills to compound pay

- RHIT/RHIA for leadership lanes.

- Add business/data skills: budgeting, variance analysis, project management, SQL basics, Excel pivots, Power BI/Tableau.

- Lean Six Sigma Yellow/Green pairs well with KPI ownership.

Portfolio: the hiring packet that wins

Keep a living, de-identified folder of wins:

- Case studies: before/after metrics, your fix, impact (accuracy %, denial %, net revenue).

- Denied → paid appeals: policy cited, documentation added, final outcome.

- Process improvements: SOPs, training, dashboards you created.

Two strong pages with charts beat a long narrative, strip PHI, keep numbers and learnings.

Quick move map: pick your next 6–12 months

- Coder hitting targets: add one high-value specialty (surgery, IR, cardio) and shadow audits weekly.

- Senior mentoring peers: formalize it, run a micro-audit, present trends, propose fixes.

- Want analytics/leadership: enroll in RHIT/RHIA and publish simple KPI dashboards.

Small, measured wins stack. Titles follow documented results.

90-Day Roadmap: From Skill to Salary Bump

| Phase | 0–30 days | 31–60 days | 61–90 days |

|---|---|---|---|

| Primary goal | Pick cert + lock exam date; baseline metrics | Specialty depth + exam pass | Add differentiator + market yourself |

| Certification step | Choose CPC or CCA (or your lane) and schedule | Sit exam in week 8–9 | Start CRC, CPMA, or denials micro-badge |

| Study rhythm | 45–60 min/day + 20 min drills | 2–3 timed mocks; error logs | Targeted modules 30–45 min/day |

| Productivity target | Baseline charts/day by setting | +10–20% volume with QA held | Sustain gains; add second metric (e.g., denials down) |

| QA target | Document accuracy baseline | ≥95–97% on internal audits | ≥97–98% with specialty complexity |

| Deliverables | Baseline report + exam booking | Pass letter + specialty notes | Resume/LinkedIn metrics + applications |

| Networking | Join 1–2 forums or chapters | Ask for a mock interview | Reach out to 10–15 hiring managers |

Days 1–30: Lock the Foundation

Cert booked, metrics baselined, first quick wins.

- Pick and book your cert:

- Starter: CPC or CCA

- Advanced: CCS or CRC (if you already have fundamentals)

Booking the exam creates a deadline that drives momentum.

- Daily loop (≈75 min/day):

- 45–60 min: guidelines, code sets, payer policy nuggets

- 20 min: timed drills

- 10 min: error review & KPI log

- Baseline your metrics:

- Charts/day by setting (pro-fee, surgery, inpatient)

- QA accuracy % = accepted-without-edit ÷ total charts

- Denial rate tied to coding (if available)

- Quick assets:

- “Cheat stack”: NCCI refs, MUE hot spots, E/M grid

- Error log: pattern → rule → correct code → source

- Micro-wins:

- Close one denial loop with a clean appeal

- Shadow CDI/auditor 1 hr → note 3 takeaways to apply tomorrow

Days 31–60: Specialty Sprint + Exam

Build specialty depth, scale speed/accuracy, and sit for your exam.

- Target one specialty module:

- E/M → MDM vs time, prolonged, split/shared

- Ortho → fracture global, injections, modifiers

- Cardiology/IR → selective vs non-selective caths, bundling edits

- Timed practice:

- 2 mocks per week (under time conditions)

- Review misses by rule, not by question; update cheat stack

- Job metrics push:

- Volume +10–20% while keeping QA ≥95–97%

- Surface one root-cause edit → propose template/tip sheet

- Exam readiness:

- Week 7: full-length mock within 5–10% of passing

- Week 8–9: sit exam; light study the day before, rest well

Days 61–90: Differentiate + Market

Stack a second skill, package your wins, and hit the market.

- Pick a differentiator:

- Risk adjustment → CRC prep, MEAT criteria, suspecting

- Auditing → CPMA-aligned checklists, 10-chart audits

- Denials → mini appeals library by denial type

- Prove value fast:

- 1-page before/after metrics report (charts/day, QA%, denials)

- Create one provider tip (de-identified) with documented impact

- Market yourself:

- Resume: “38→48 charts/day; 97.2% QA; –22% coding denials”

- LinkedIn headline: “CPC (pending/pass) | E/M + Ortho | QA 97%+”

- Apply to 10–20 roles (hospital, payer, vendor, remote mix)

- Negotiation prep:

- Phrase: “Given X charts/day at Y% accuracy plus [Cert], a range of A–B is aligned with current market data.”

- If budget fixed → ask for CEU $, exam fees, remote stipend, and a 6-month review

Weekly KPI Tracker

- Charts/day (by specialty)

- QA accuracy %

- Denial rate %

- Turnaround time per chart (minutes)

- Exam readiness score (latest mock %)

Reuse Checklist

☑ Exam booked

☑ Baseline metrics captured

☑ Specialty module picked

☑ Two mocks completed

☑ Differentiator selected

☑ Resume + LinkedIn updated

☑ 10–20 targeted applications sent

Common Questions

Always compare total compensation, not just the hourly or base rate. That means:

- Base salary or hourly pay

- Bonuses (productivity, quality, or annual)

- Benefits (PTO, health, retirement)

- CEU/exam coverage and stipends

For piece-rate work (per chart, per RVU), back-solve to your effective hourly rate at your typical charts/hour and accuracy level. That’s the real number that matters.

Which Certification Raises Salary Fastest?

- Outpatient / Pro-Fee: Start with CPC (AAPC). It’s the most widely recognized entry and unlocks multi-specialty coding.

- Hospital / Inpatient: Go CCA → CCS (AHIMA). CCS signals facility coding depth and DRG expertise.

- Risk Adjustment (HCC): CRC (AAPC). Huge seasonal/project demand here.

- Auditing / Education: CPMA (AAPC), usually after CPC/CCS + strong QA metrics.

- Leadership / Ops: RHIT or RHIA (AHIMA), tied to degree paths.

Check out the latest insights on RHIA salary in 2025 – explore pay ranges, top roles, and how location impacts earnings:

RHIA Salary in 2025: Pay Ranges, Roles & Locations

Smart stack combos:

- CPC → CRC for HCC vendor and payer projects

- CPC/CCS → CPMA for auditor pay bands

- CCA → CCS to step into inpatient coder or DRG validator roles

Tip: Book your next exam within 60–90 days and tie it to a measurable skill goal (e.g., boost E/M accuracy by 5–10%).

Which States Pay the Most?

Highest salaries are often in high-cost, high-demand metros:

- California

- Washington

- Massachusetts

- New Jersey

- New York

- DC-Metro area

But pay policy matters: some employers peg pay to employee location, others to HQ location. Always check before comparing offers.

Why pay varies:

- Cost of living differences

- Hospital density and payer mix

- Remote competition and demand

Fast research workflow: Pull BLS “Medical Records Specialists” data → cross-check AAPC/AHIMA salary insights → scan job postings for your specialty in your state.

Can You Start Entry-Level and Go Remote Later?

Yes. Many coders start onsite or hybrid for 6–12 months under mentorship, then pivot remote once they have measurable performance.

Make the switch easier by tracking:

- Productivity: charts/day or records/hour, by specialty

- Quality: QA accuracy rate, denial reduction wins

- Tools: encoder/EHR proficiency, claim scrubber use

- Compliance: HIPAA training, secure workspace, dual-factor login readiness

Is Medical Billing & Coding Salary Strong in 2025?

Yes, demand remains strong and steady. Why:

- Aging population → more medical encounters to code

- Risk adjustment (HCC) growth

- Complex payer rules and compliance needs

What it means for you:

- Stable hiring in hospitals, large physician groups, and payers

- Remote openings continue, tied to productivity and QA targets

- Pay levers: E/M mastery, DRG/APC logic, HCC skills, denial prevention, clean documentation

Annual vs Hourly Pay

- Annual (W2): Steady, includes benefits (health, PTO, retirement match). Safer for most coders.

- Hourly (1099 or contract): Higher raw pay, but no benefits. You cover taxes, CEUs, and downtime.

- Piece-Rate: Depends entirely on your speed and QA accuracy. Always convert to effective hourly before comparing.

Bottom line: 2025 is a solid year for medical coding salaries. Credentials + measurable output (charts/day, QA %, denial reduction) = the fastest path to higher pay.

| Organization | Credential / Resource | Best for | Official link |

|---|---|---|---|

| AAPC | CPC — Certified Professional Coder | Physician/pro-fee outpatient coding; solid starter | https://www.aapc.com/certifications/cpc/ |

| AAPC | CPB — Certified Professional Biller | Claims, denials, EDI workflows, payer policy | https://www.aapc.com/certifications/cpb/ |

| AAPC | CRC — Certified Risk Adjustment Coder | HCC/risk adjustment (MA, ACA); seasonal projects | https://www.aapc.com/certifications/crc/ |

| AAPC | CIC — Certified Inpatient Coder | Facility inpatient; ICD-10-PCS and MS-DRGs | https://www.aapc.com/certifications/cic/ |

| AAPC | COC — Certified Outpatient Coder | Hospital outpatient departments; APC logic | https://www.aapc.com/certifications/coc/ |

| AAPC | CPMA — Certified Professional Medical Auditor | Auditing, compliance, education tracks | https://www.aapc.com/certifications/cpma/ |

| AAPC | CDEO — Certified Documentation Expert Outpatient | Provider documentation quality; E/M mastery | https://www.aapc.com/certifications/cdeo/ |

Quick How-to…?

- Pick the credential that aligns with your career lane.

- Read the exam’s eligibility and content outline.

- Note CEU and renewal requirements so you’re not surprised later.

- Bookmark the official cert page, titles may vary by employer, but requirements don’t.

Final Take