FMVA certification is becoming a must‑have if you’re serious about financial modeling and valuation. The Corporate Finance Institute runs the show and it’s not a diploma mill. This certification program is designed to make you stand out among financial professionals in fields like investment banking, corporate finance, private equity, or equity research.

You get hands‑on with building comprehensive financial models, understanding financial statements, and doing financial statement analysis, not just theory. More than that, it’s built for busy professionals, with online courses you can take at your own pace, and choose either the self-study subscription or the full immersion subscription.

So yeah, if you are chasing career advancement in the finance industry and aiming for a successful finance career, especially for roles like financial analyst, investment analyst, or valuation analyst, this might be your ticket. Let’s unpack this further.

What Is the FMVA Certification?

FMVA stands for Financial Modeling & Valuation Analyst (sometimes called financial modeling valuation analyst FMVA). The FMVA certification program gives you:

- Strong financial modeling and valuation skills

- Ability to build real‑world, comprehensive financial models

- Mastery of key financial ratios, financial health, and cash flow analysis

- Deep dive into business valuation and valuation methodologies

- Strong financial data chops through Excel conduct data analysis

You will run DCFs, build three‑statement models (P&L, balance sheet, cash flow), do sensitivity analysis, and perform simple yet essential skills that real finance pros use. It’s also about making informed investment decisions using different valuation methodologies, so roles in equity research, private equity, or investment banking find it valuable.

Who Needs the FMVA Certification, And Why?

If you are thinking “Hmm…should I get this?” here’s a quick check‑list:

- A budding financial analyst trying to show serious Excel chops

- A finance professional in FP&A or treasury wanting more modeling muscle

- Switching into investment banking or private equity

- Love playing with key financial ratios, income statement modeling, and financial performance tracking

- Crave roles like valuation analyst or investment analyst

- Tired of awkward modeling styles at work and want to elevate your desk‑jockey creds

Plus, if you are deadline‑driven and considering elective courses , job application opened tomorrow? You can binge the prep courses and core stuff. Or if you are pace‑steady, take your time, all saved online, you pass the final exam whenever you’re ready.

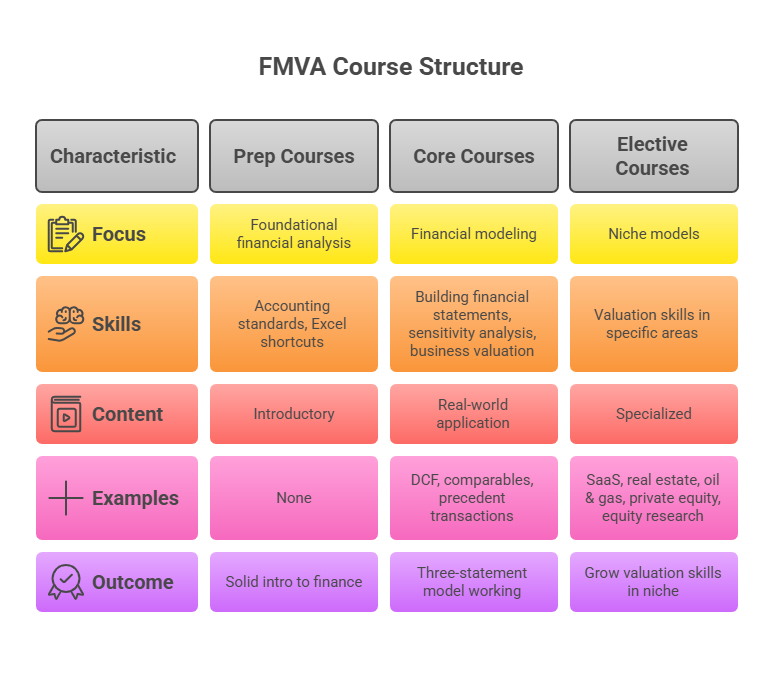

FMVA Course Structure Overview

Prep Courses

These get you comfortable with detailed accounting standards, Excel shortcuts, and foundational financial analysis basics. Solid intro if your finance background could use a tune‑up.

Core Courses

This is the heart of the FMVA certification program, focusing on financial modeling . You roll up your sleeves and learn to:

- Build income statement, balance sheet, and cash flow models

- Use sensitivity analysis and scenario modeling

- Dive into business valuation methods like DCF, comparables, precedent transactions

The moment you see a three‑statement model working, you will get it, it’s real world stuff, not textbook fluff.

Elective Courses

Need niche models? This is for you. Options like SaaS, real estate, oil & gas, private equity, or equity research modeling. This program helps grow valuation skills in your niche, preparing you for investment opportunities.

You pick 3 electives, so you can focus on areas like financial planning, or sharpen valuation analyst skills.

This ability to specialize is crucial, as different industries have their own “gold standard” credentials. In healthcare technology, for instance, professionals pursue an Epic certification to master the dominant electronic health records system, proving that specialized knowledge is key to career growth everywhere.

Certification Process & Exam Details

Here’s how to cross the finish line in the competitive finance industry :

- Sign up with either self study subscription or full immersion subscription

- Knock out all prep courses (these are optional, but smart)

- Finish the 14 core courses

- Choose and complete 3 elective courses

- Take the final exam, requiring 70% to pass

The final exam is an online assessment; open‑book, timed, challenging enough, but fair. It tests you on modelling, valuation, financial analysis, and maybe some income statement intricacies. There’s a 0/25–35 type section, like scoring buckets or question counts. Don’t get thrown by obscure topics like 2/28–80 or 0/6–11, but be ready for situational problems.

How Long Does the Preparation Take?

CFI suggests 120–200 hours total. If you go heavy, that’s a full immersion model in a month. Most go 3 to 6 months at a steady pace (2‑3 hours daily). You can pause, redo, take slices whenever, it’s made for folks with full‑time jobs, aka busy professionals.

Level Of Difficulty of the FMVA Exam?

This isn’t CFA-hard, but it’s more than Excel basics. The difficulty is often compared to other hands-on vocational exams, where success depends on practical application rather than pure memorization. For perspective, IT professionals often wonder how hard the CompTIA Network+ certification is, which has a similar focus on job-ready skills.

- You must follow real workflows: pulling numbers into your financial analysis, stress‑testing models with sensitivity analysis, and synthesizing valuation output.

- You need to crunch common financial ratios and interpret company financial health.

- You’ll structure comprehensive financial models, sometimes with more than 500 cell formulas.

If you binge the practice files and stay consistent, you’ll do fine. But if you skip exercises that are crucial for finance professionals , you’ll struggle on the final exam.

What Makes CFI & FMVA Stand Out?

- Business-focus: The program is built for real‑world applications, not just theory.

- Excel-first: You actually build models step by step.

- Diverse electives: You can go SaaS, real estate, private equity, or equity research.

- Self-paced: Start or stop whenever works best for you.

- Recognition: Firms know Corporate Finance Institute and value the credential.

Crunching the Numbers: Cost vs Return

FMVA Certification Cost

The cost of the fmva certification ranges between $497–$847/yr depending on subscription. The full immersion tier gets you live training and extra tools. No hidden exam fees.

While the FMVA certification has a clear subscription model, it’s interesting to see how this compares to technical fields. For instance, the GCP certification cost is structured around individual exam fees, reflecting a different industry’s approach to professional credentialing.

Return on Investment

- Higher base salary (think $60K–$80K early, mid‑6 figures later)

- Helps break into corporate finance, investment banking, or private equity

- Adds credibility as a certified financial modeling pro

- Enables tracking of career advancement, employers see your skill

If employers pitch in, or you get reimbursed, it’s practically free, making it a valuable asset to your career .

Skills Learned & Career Benefits

Practical Skills & Core Concepts

- Understand key financial ratios, financial performance, and financial health

- Own building a comprehensive financial model—forecasts, revenue, CapEx, depreciation, debt

- Run real cash flow analysis & balance sheet recon

- Understand business valuation and valuation methodologies (DCF, multiples)

- Improve workflow with Excel: pivot tables, data tables, excel conduct data analysis

The salary uplift is a significant driver for many candidates. This trend of specialized skills leading to higher earning potential isn’t unique to finance; the rapidly growing field of cybersecurity, for example, sees a substantial digital forensics salary for certified experts.

Interview Hooks

- “I built a full 3‑statement model for a SaaS co. using FMVA case study.”

- “I know how to run sensitivity & scenario models to test deal assumptions.”

- “I can walk you through a DCF and valuation multiples, and explain drivers behind changes.”

Recruiters dig it, because you can walk up to a spreadsheet and diagnose it in minutes.

End‑Of‑Course Assessment & Final Exam

Every course ends with a wrap quiz or course assessment. Some have case‑based challenges, like excel modeling case studies, where you build or fix a small model.

At the end, you take the full fmva certification exam, covering all areas from financial analysis to valuation. It’s timed, has numeric inputs, and mixes theory with practice.

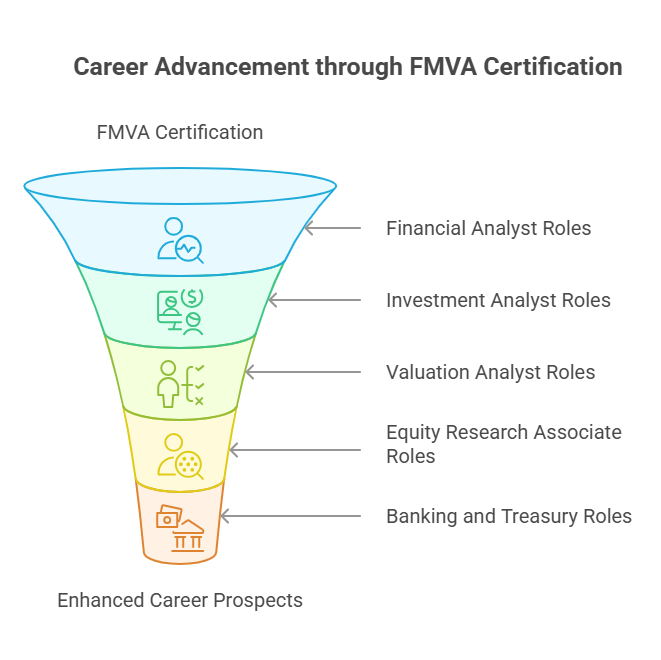

Career Opportunities & Paths after FMVA Certification Program

Once you’re FMVA certified, doors open. You’ll find jobs with titles like:

- Financial analyst or FP&A analyst

- Investment analyst

- Valuation analyst

- Equity research associate

- Roles at investment banking, private equity, or corporate treasury teams

The clear career progression and salary bumps in finance are mirrored in other specialized sectors like healthcare administration. There, professionals often debate the CPC vs CCS salary outcomes to determine which certification offers the best career trajectory.

This badge also shows up in listings like “experience with financial modeling and valuation required.”

How FMVA Stacks Up Against Other Financial Certs

- CFA is broader, asset management, ethics, and portfolio theory. FMVA zooms into modeling & valuation.

- CPA is heavy on accounting and audit. FMVA is about modeling real‑world finance, forecasting, and valuation.

- CMA covers cost accounting, and budgeting. FMVA is more Excel‑ and valuation‑centric.

Similarly, professionals in corporate environments often weigh the benefits of credentials that govern enterprise systems, leading them to research the SAP certification cost as a complementary skill set for managing company-wide financial data.

They complement each other. A CPA gets stronger modeling with FMVA. A CFA get stronger forecasting tools. So if you’re thinking “one‑size‑fits‑all”, FMVA is great to pair with another cert as a valued asset.

Follow the complete FMVA certification guide.

Is FMVA Certification Worth It?

Simple answer: yes. If you are chasing a serious role in finance, this adds weight. If you’re just curious or dabbling, it may be overkill.

Pros

- Builds real, practical skill

- Invest once, access for a year

- Stand‐out in interviews

- Recognized by finance firms

- Helps with career advancement

Cons

- Requires time commitment (120‑200 hrs)

- Need to commit to exercises

- Extra cost if you don’t get employer reimbursement

Overall, it delivers far more than its price tag if you use it.

Tips to Succeed

- Set a plan: e.g., 3 courses/week

- Do every excel modeling case study and course assessment

- Pause after each module, recap major concepts—like key financial ratios

- Choose electives that support your path, IB, PE, SaaS, etc.

- Use the forums, community helps a ton

- When ready, block out 2‑3 hours for the final exam

Section Walkthrough for Preparation.

Prep Courses

Brush up on accounting basics, detailed accounting standards, and Excel tricks like VLOOKUP, INDEX/MATCH, formatting, data tables, pivot charts, and more.

Core Courses

The main bulk, split into segments:

- Financial modeling fundamentals (revenue, costs, forecasting)

- Building the income statement, balance sheet, cash flow statements

- Financial statement analysis and key financial ratios

- Sensitivity analysis and scenario mapping

- Business valuation techniques, including DCF and comparables

You also tackle comprehensive financial models in real sector examples.

Electives

Cover niche areas:

- SaaS modeling with revenue churn and subscription forecasting

- Private equity case with LBO structures

- Equity research model with valuation output

- Real estate or mining models with project‑specific tools

These electives develop your valuation skills further.

Final Exam

Timed, multi‑section. You must score 70%+.

Expect real‑world style questions, build part of a model, calculate ratios, answer scenario queries.

Becoming a FMVA Certified Professional

Once you pass:

- You’re added to the CFI alumni network

- You get a digital certificate to flaunt on LinkedIn

- You can list your title as “FMVA certified professional” or “Financial Modeling and Valuation Analyst (FMVA)”

- Access library stays active while your subscription is live

This is the part where you can really say the FMVA certification offers you serious model‑building credentials and opens doors for exciting career opportunities.

Potential Jobs Post-FMVA

Here’s who’s hiring:

- Investment banking analysts – strong modeling and presentation capability

- Private equity associates – run due diligence and valuation models

- Equity research analysts – build valuation comps, DCF, forecast earnings

- Valuation analyst roles in consultancy or advisory

- FP&A or treasury jobs focused on budgeting and forecasting

Many job descriptions now include “advanced Excel and financial modeling” as a requirement, exactly what you’ll have.

Final Word

FMVA certification isn’t just another tick-in-the-box, it’s real training, with real models, taught via online courses that sync with your schedule. You learn financial modeling and valuation with enough depth to tackle a final exam, crush interviews, and land roles in corporate finance, investment banking, private equity, or equity research.

Yes, you invest time (120–200 hours) and money ($497–$847/yr), but what you learn translates directly into career gains. You’ll walk into meetings knowing your financial data skillset is legit, you can present a cash flow model on the fly, assess a company’s financial performance, and navigate balance sheets like a pro.

If you’re shooting for a successful career in finance and want a credential that proves you’re more than just theoretical, FMVA hits the sweet spot. It gives you credibility, confidence, and core capabilities to handle real world problems. Cert Empire offers some of the best FMVA certification exam dumps out there. Their updated practice questions mirror the real exam and help you build confidence fast. Thousands of finance professionals trust them, and it’s easy to see why.

FAQs

Is the FMVA certification worth it in 2025?

Absolutely. FMVA certification is still highly relevant and respected in 2025, especially for finance professionals aiming to sharpen their skills in financial modeling and valuation. It’s a solid way to boost your career in investment banking, equity research, corporate finance, or private equity.

How hard is the FMVA final exam?

The FMVA final exam is manageable if you’ve gone through the core courses, elective courses, and prep courses properly. It’s more about applying concepts like financial statement analysis, financial modeling, and valuation techniques rather than memorizing theory.

How long does it take to finish the FMVA program?

On average, most people take about 4–6 months to complete the FMVA certification program, depending on how much time they can commit each week. Since it’s self-paced, you can move through it at your own pace.

Can I pass the FMVA certification exam with exam dumps?

Exam dumps should never replace actual study, but they’re a helpful tool for revision and practice. Using Cert Empire’s FMVA exam dumps alongside the official materials can improve your understanding and confidence before taking the final exam.

Do I need any prior experience or qualifications to enroll in the FMVA program?

No formal degree or job experience is required. However, having a basic understanding of accounting and Excel helps. The prep courses included in the program are designed to get beginners up to speed.

What’s the difference between self-study and full-immersion subscription?

The self-study subscription gives you access to the core content at a lower cost, while the full immersion subscription adds extra features like additional course assessments, priority support, and certification prep tools, great for busy professionals who want guided learning.

Are FMVA-certified professionals getting better jobs?

Yes, many FMVA-certified professionals secure roles with higher pay and increased responsibility. Employers know the program focuses on real-world applications like cash flow analysis, valuation modeling, and financial planning, skills that are useful from day one on the job.

Can I get a job in investment banking or private equity with just the FMVA certification?

The FMVA certification alone might not guarantee a job in investment banking or private equity, but it strengthens your resume. It shows employers you’ve got hands-on skills in financial modeling, valuation methodologies, and financial statement analysis, key areas they care about.

What tools and software are used in the FMVA program?

Mostly Excel. The FMVA program includes Excel modeling case studies and teaches how to use Excel to build comprehensive financial models, conduct sensitivity analysis, and analyze financial data. There’s no need for high-end software, just a solid grasp of spreadsheets.

What happens if I fail the FMVA final exam?

If you don’t pass the final exam on your first try, you can retake it. The Corporate Finance Institute usually allows multiple attempts without extra fees, but it’s best to double-check their current policy. Prepping with practice tests and Cert Empire’s exam dumps can help avoid this.

Does the FMVA certification expire?

No, the FMVA certification doesn’t expire. Once you’re certified, it’s yours for life. However, it’s smart to keep your knowledge up to date, especially if you want to stay competitive in the finance industry.

Can I access FMVA content offline?

Not directly. Since it’s an online certification program, you need an internet connection to access the lessons and course materials. Some files may be downloadable, but interactive content and online assessments require the internet.

Will FMVA help me if I already work in finance?

Yes, even experienced professionals in corporate finance, equity research, or financial analysis can benefit. The FMVA program adds depth to your existing skills and helps you build better models, improve valuation accuracy, and become more confident in making informed investment decisions.

Last Updated on by Team CE