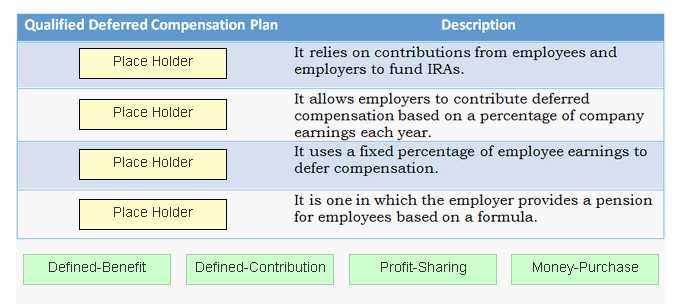

The following are the types of Qualified Deferred Compensation Plans: Defined Benefit Plan: A defined benefit plan is one in which the employer provides a pension for employees based on a formula. Defined Contribution Plan: A defined contribution plan relies on contributions from employees and employers to fund IRAs. Profit Sharing Plan: A profit sharing plan allows employers to contribute deferred compensation based on a percentage of company earnings each year. Money Purchase Plan: A money purchase plan uses a fixed percentage of employee earnings to defer compensation. Chapter: Compensation and Benefits Objective: Benefits