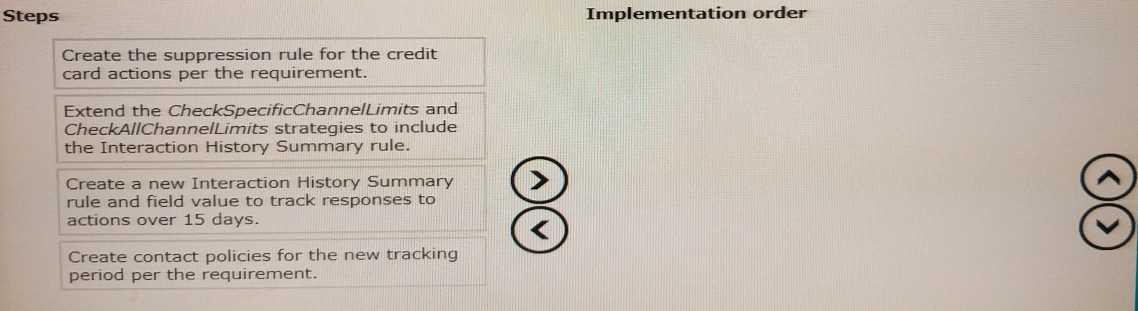

DRAG DROP A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within 15 days. Put the steps in the correct order to implement this task.

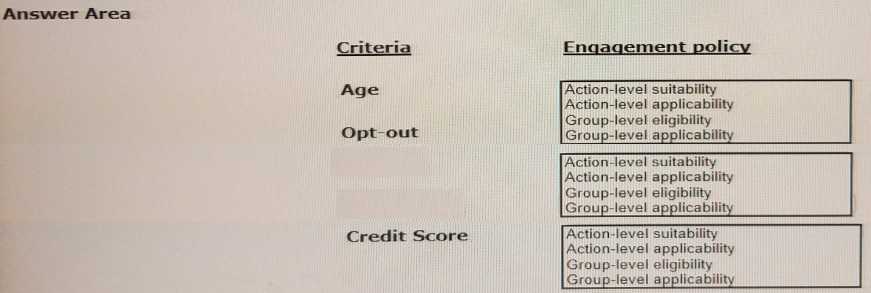

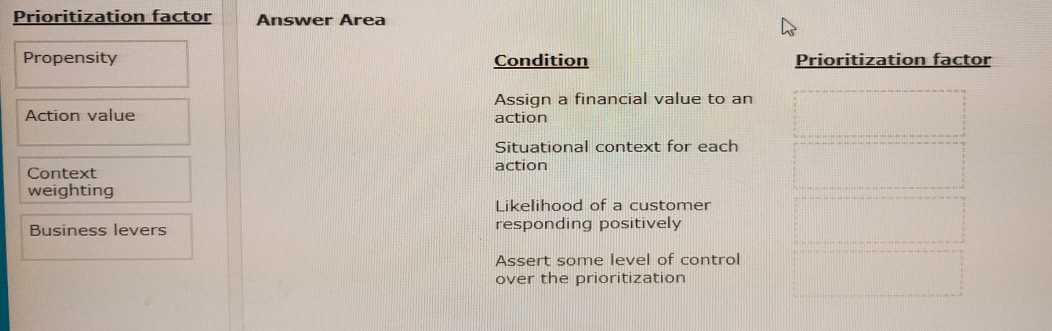

DRAG DROP You are a decisioning consultant responsible for configuring offer prioritization for home loan offers based on the business requirements. Select each prioritization factor on the left and drag it to the correct condition on the right.

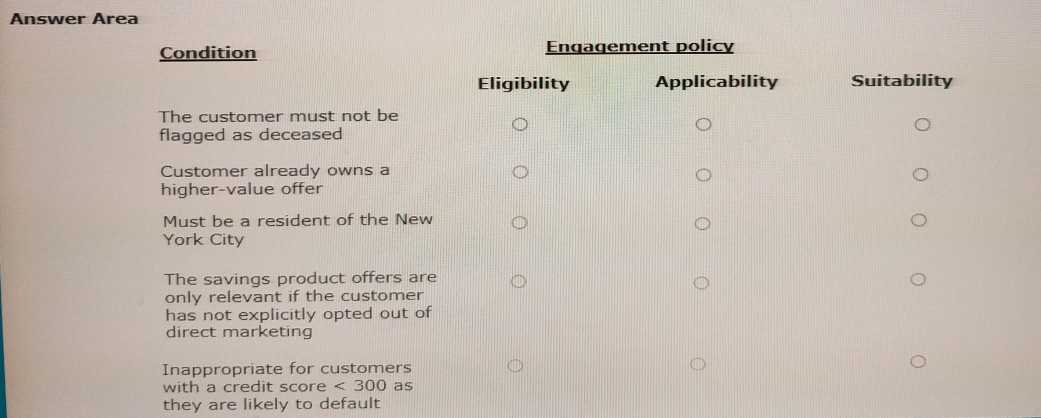

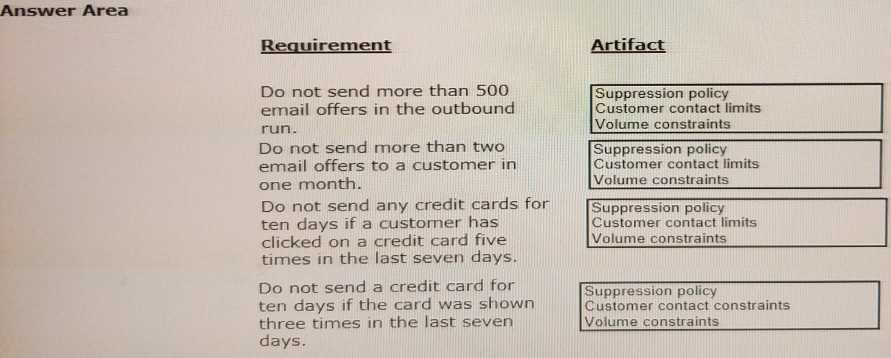

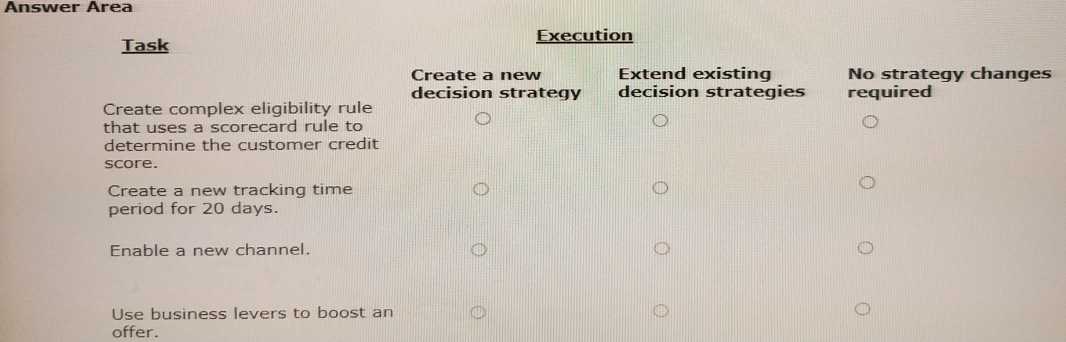

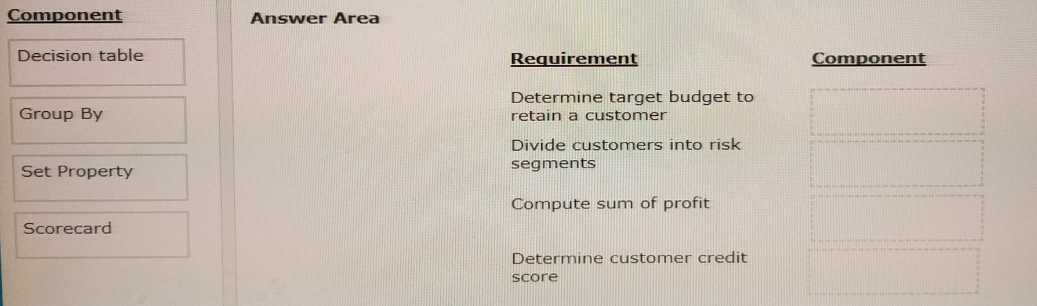

DRAG DROP You are a strategy designer on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the left and drag it to the correct requirement on the right.

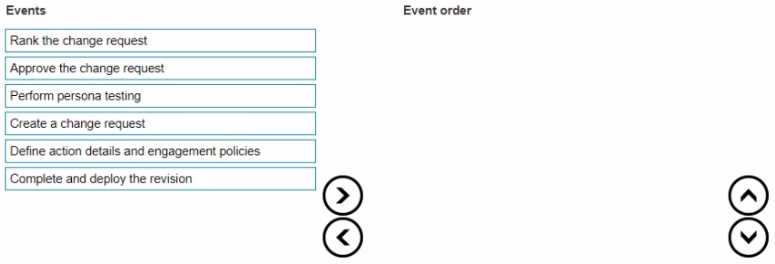

DRAG DROP U+ Bank a retail bank is cross-selling on the web by showing various credit card offers to its customers. The bank wants to introduce a new offer in the Business Operations Environment Place the steps in the correct order of implementation.

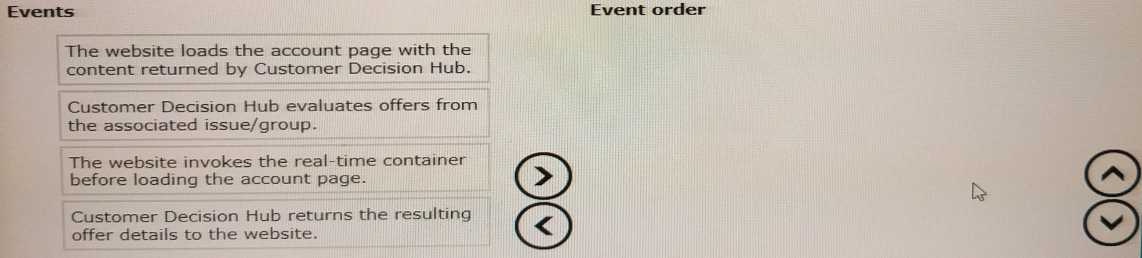

DRAG DROP The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer. Place the events in the sequential order.