Q: 11

U+ Bank implemented a customer journey for its customers. The journey consists of three stages.

The first stage raises awareness about available products, the second stage presents available offers,

and in the last stage, customers can talk to an advisor to get a personalized quote. The bank wants to

actively increase offers promotion over time.

What action does the bank need to take to achieve this business requirement?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 12

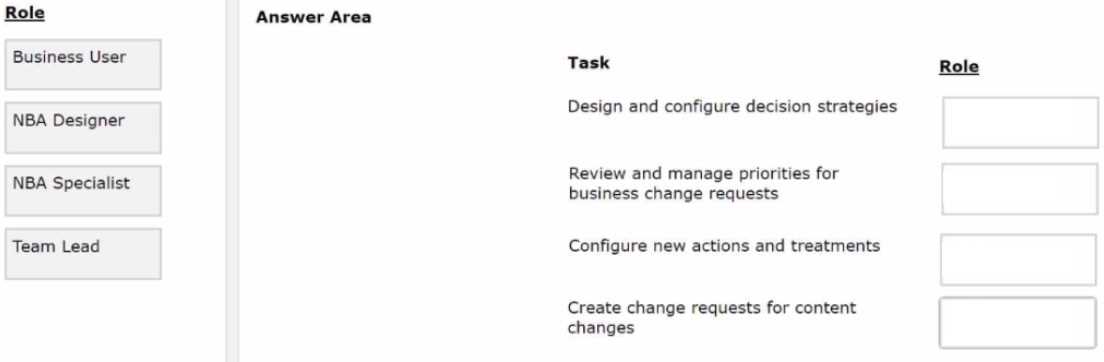

DRAG DROP

U+ Bank, a retail bank, uses the Business Operations Environment to perform business changes. The

team members of the Business Content team and Enterprise Capabilities team perform several roles

in the change management process.

Select each role on the left and drag it to the task descriptions to which the role corresponds on the

right.

Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 13

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer.

U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 14

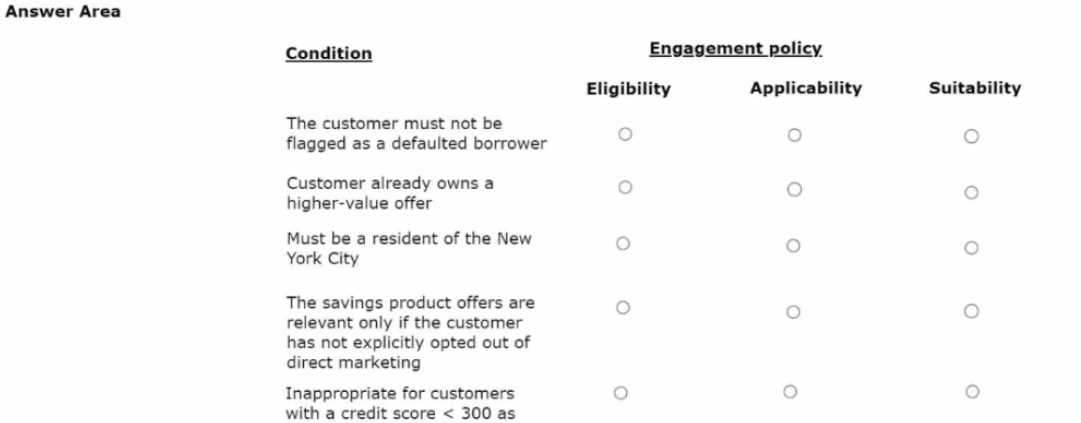

HOTSPOT

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented

to qualified customers when they log in to the web self-service portal. The bank added engagement

policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Question 11 of 20 · Page 2 / 2