Q: 11

According to the FASB's conceptual framework, the process of reporting an item in the financial

statements of an entity is:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 12

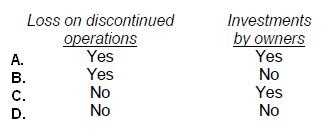

According to the FASB conceptual framework, comprehensive income includes which of the

following?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 13

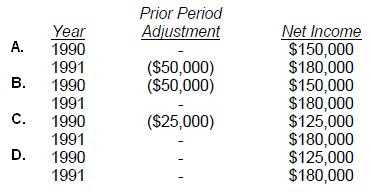

While preparing its 1991 financial statements, Dek Corp. discovered computational errors in its 1990

and 1989 depreciation expense. These errors resulted in overstatement of each year's income by

$25,000, net of income taxes. The following amounts were reported in the previously issued financial

statements:

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 14

Thorpe Co.'s income statement for the year ended December 31, 1990, reported net income of

$74,100. The auditor raised questions about the following amounts that had been included in net

income:

The loss from the fire was an infrequent but not unusual occurrence in Thorpe's line of business.

Thorpe's December 31, 1990, income statement should report net income of:

The loss from the fire was an infrequent but not unusual occurrence in Thorpe's line of business.

Thorpe's December 31, 1990, income statement should report net income of:

The loss from the fire was an infrequent but not unusual occurrence in Thorpe's line of business.

Thorpe's December 31, 1990, income statement should report net income of:

The loss from the fire was an infrequent but not unusual occurrence in Thorpe's line of business.

Thorpe's December 31, 1990, income statement should report net income of:Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 15

Under FASB Statement of Financial Accounting Concepts #5, which of the following items would

cause earnings to differ from comprehensive income for an enterprise in an industry not having

specialized accounting principles?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 16

On January 1, 1991, Brecon Co. installed cabinets to display its merchandise in customers' stores.

Brecon expects to use these cabinets for five years. Brecon's 1991 multi-step income statement

should include:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 17

The following costs were incurred by Griff Co., a manufacturer, during 1992:

What amount of these costs should be reported as general and administrative expenses for 1992?

What amount of these costs should be reported as general and administrative expenses for 1992?

What amount of these costs should be reported as general and administrative expenses for 1992?

What amount of these costs should be reported as general and administrative expenses for 1992?Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 18

On August 31, 1992, Harvey Co. decided to change from the FIFO periodic inventory system to the

weighted average periodic inventory system. Harvey is on a calendar year basis. The cumulative

effect of the change is determined:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 19

APB Opinion No. 28, Interim Financial Reporting, concluded that interim financial reporting should

be viewed primarily in which of the following ways?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 20

Taft Corp. discloses supplemental industry segment information. The following information is

available for 1992:

Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200

General corporate expenses 4,800

Segment C's 1992 operating profit was:

Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200

General corporate expenses 4,800

Segment C's 1992 operating profit was:

Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200

General corporate expenses 4,800

Segment C's 1992 operating profit was:

Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200

General corporate expenses 4,800

Segment C's 1992 operating profit was:Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Question 11 of 20 · Page 2 / 2