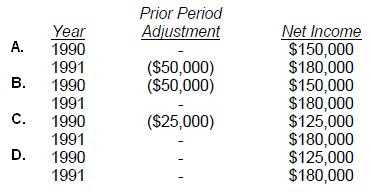

Q: 13

While preparing its 1991 financial statements, Dek Corp. discovered computational errors in its 1990

and 1989 depreciation expense. These errors resulted in overstatement of each year's income by

$25,000, net of income taxes. The following amounts were reported in the previously issued financial

statements:

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be

reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial

statements?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.