Q: 11

An organization is considering purchasing a new machine which will cost $600,000. The new machine

will generate cost savings of $200,000 each year for five years. The cost of capital is 12%.

The profitability index (PI) for the investment in the new machine is:

Give your answer to one decimal place.

Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 12

The following summarised financial statements have been prepared by JNM's North subsidiary for

the year just ended:

Calculate the North subsidiary's Residual Income, assuming that JNM's cost of capital is 10%.

Give your answer to the nearest $ million.

Calculate the North subsidiary's Residual Income, assuming that JNM's cost of capital is 10%.

Give your answer to the nearest $ million.

Calculate the North subsidiary's Residual Income, assuming that JNM's cost of capital is 10%.

Give your answer to the nearest $ million.

Calculate the North subsidiary's Residual Income, assuming that JNM's cost of capital is 10%.

Give your answer to the nearest $ million.Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 13

A company comprises several divisions.

One of these divisions was originally expected to earn an operating profit next year of $800,000 on

net assets of $4 million.

However, the divisional manager is considering investing in a project that would generate a project

return on investment (ROI) of 38% on additional net assets of $500,000.

What would be the divisional ROI next year if the project was implemented?

Give your answer to the nearest percentage.

Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 14

A project requires an initial investment of $50,000. It will generate positive cash flows for two years

as follows.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 15

A large supermarket is applying direct product profitability analysis to establish the profit earned by

each of the products it sells.

Data for product P are as follows.

The shelf is stacked each time that all units are sold and there are no units of product P left unsold at

the end of each day.

What is the direct product profit per unit of product P?

Give your answer to the nearest $0.01.

The shelf is stacked each time that all units are sold and there are no units of product P left unsold at

the end of each day.

What is the direct product profit per unit of product P?

Give your answer to the nearest $0.01.

The shelf is stacked each time that all units are sold and there are no units of product P left unsold at

the end of each day.

What is the direct product profit per unit of product P?

Give your answer to the nearest $0.01.

The shelf is stacked each time that all units are sold and there are no units of product P left unsold at

the end of each day.

What is the direct product profit per unit of product P?

Give your answer to the nearest $0.01.Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 16

A firm of accountants uses an activity-based costing system. The firm's costing system permits staff to

indicate specific tasks undertaken for clients, such as requesting missing information. The amount

charged for a request for missing information is based on the following analysis.

Each request takes an average of 15 minutes of professional staff time. Professional staff are charged

out at $100 per hour.

Administrators then process the information request and prepare a standard letter. The average time

administration staff spend on each information request is 20 minutes. The cost of administration staff

at the firm is $75,600 per year. Administration staff work for a total of 6,000 hours per year. The cost

of printing and posting a letter is $1.

Calculate the cost of an information request.

Give your answer to 2 decimal places.

Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

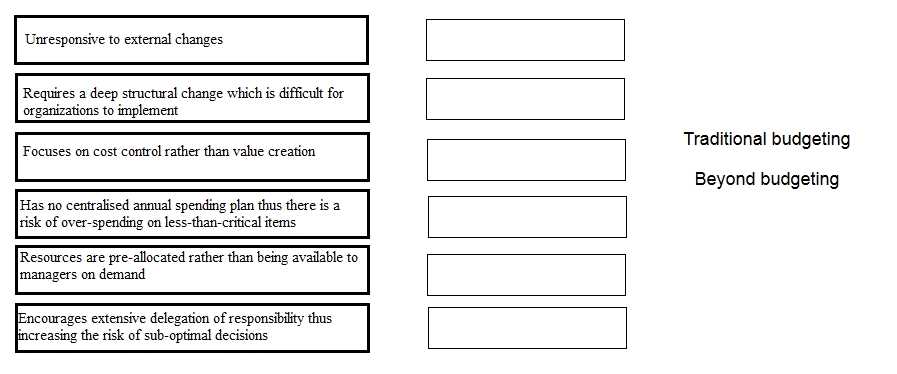

Q: 17

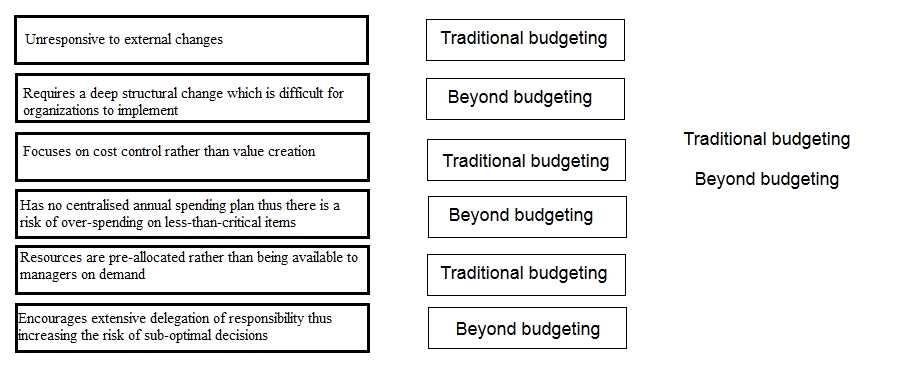

DRAG DROP Which of the following criticisms relate to traditional budgeting methods and which relate to the 'beyond budgeting' approach?

Drag & Drop

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 18

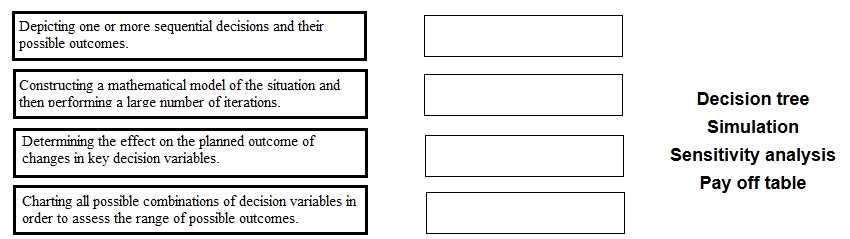

DRAG DROP Place each method of analysing risk and uncertainty against the statement that describes it correctly.

Drag & Drop

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

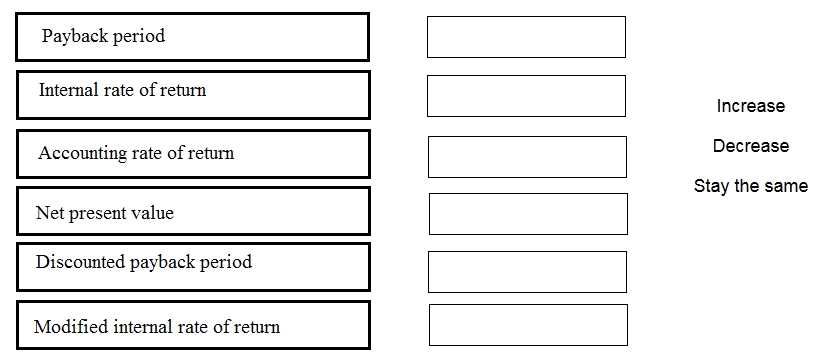

Q: 19

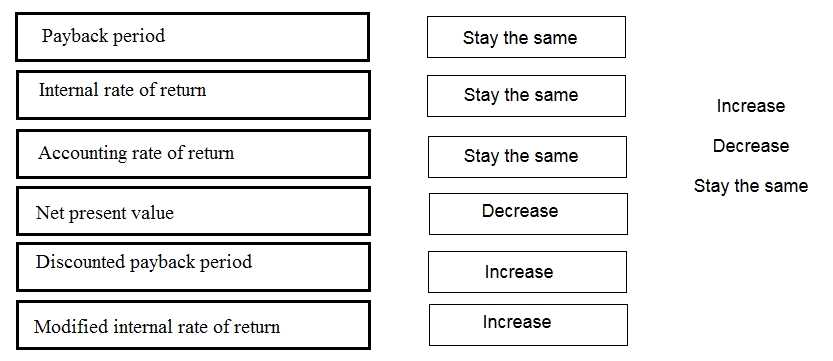

DRAG DROP An investment appraisal has identified that a project has a positive net present value when discounted at the company's cost of capital. If the cost of capital is now increased, indicate whether each of the following appraisal measures will increase, decrease or stay the same.

Drag & Drop

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Question 11 of 20 · Page 2 / 2