Q: 1

A company operates a divisional structure. The manager of division D receives a bonus based on the

division's annual return on capital employed (ROCE).

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases

in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus.

The manager is considering an investment in a new machine for next year. The incremental ROCE

earned by the machine is expected to be 19% although the ROCE for the division as a whole with the

machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%.

The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 2

Risk management can be represented as a four step process. The four steps, shown randomly, are:

1. Establish appropriate risk management policies.

2. Risks are identified by key stakeholders.

3. Risks are monitored on an ongoing basis.

4. Risks are evaluated according to the likelihood of occurrence and impact on the organization.

Which of the following is the correct order for the four steps?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 3

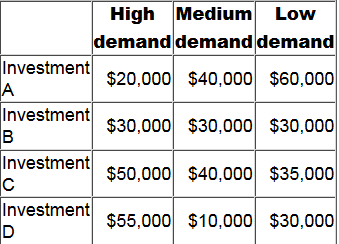

A company is considering four mutually exclusive projects. There are three possible future demand

conditions but the company has no idea of the probability of each of these demand conditions

occurring. The forecast net present values (NPVs) of each of the four projects, under each of the

three possible future demand conditions, are as follows.

Using the maximax criterion, which investment should be selected?

Using the maximax criterion, which investment should be selected?

Using the maximax criterion, which investment should be selected?

Using the maximax criterion, which investment should be selected?Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 4

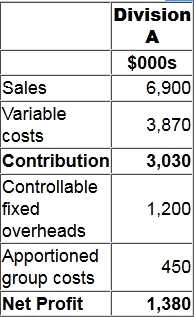

Division A is an investment centre with assets of $7.3 million. The following is an extract from the

annual budget for division A:

The cost of capital is 14%.

Calculate the residual income for division A.

The cost of capital is 14%.

Calculate the residual income for division A.

The cost of capital is 14%.

Calculate the residual income for division A.

The cost of capital is 14%.

Calculate the residual income for division A.Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 5

One aspect of life cycle costing is the recognition of the fact that during the design or development

stage a large proportion of many products' life cycle costs are:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 6

A learning curve applies to the manufacture of the first 256 units of a product.

During the manufacture of the first 255 units, the time taken to produce each successive unit is

expected to:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 7

A project with a 6 year life generates a positive net present value of $1,100. The discount rate is 8%.

To the nearest $, the equivalent annual benefit is:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 8

A company is classifying its quality costs to prepare a quality cost report. Which of the following are

conformance costs?

Select ALL that apply.

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 9

$30.328 million is to be invested in a project that will yield annual net cash inflows of $8 million for 5

years.

What is the project's internal rate of return (IRR)?

Give your answer to the nearest whole percentage.

Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 10

SQ has the opportunity to invest in project X. The net present value for project X is $12,600. Cash

inflows occur in years 1, 2 and 3. The company's cost of capital is 14%.

Calculate the annualized equivalent annuity of project X.

Give your answer to the nearest whole $.

.

Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Question 1 of 20 · Page 1 / 2