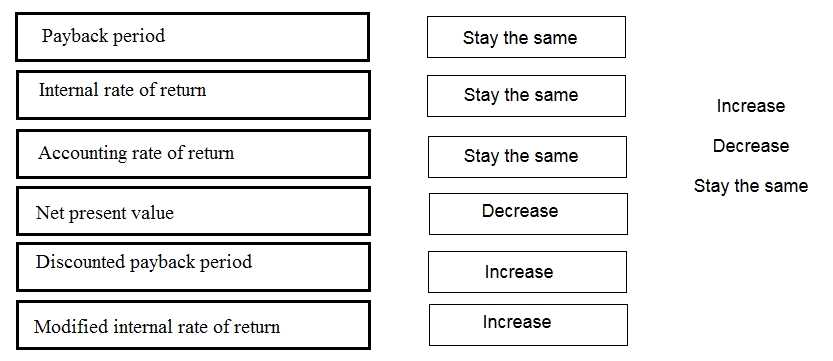

Ross, S. A., Westerfield, R. W., & Jaffe, J. (2013). Corporate Finance (10th ed.). McGraw-Hill Education.Chapter 5 (Net Present Value and Other Investment Rules): Section 5.1 covers NPV's inverse relationship with the discount rate. Section 5.5 covers IRR as a rate intrinsic to cash flows, independent of the market rate.Brealey, R. A., Myers, S. C., & Allen, F. (2019). Principles of Corporate Finance (13th ed.). McGraw-Hill Education.Chapter 5 (Net Present Value and Other Investment Criteria): Page 134 discusses the Payback rule (independent of discounting). Page 136 discusses the Discounted Payback rule.Brigham, E. F., & Ehrhardt, M. C. (2013). Financial Management: Theory & Practice (14th ed.). Cengage Learning.Chapter 10 (The Basics of Capital Budgeting): Page 404, Section 10-5 "Modified Internal Rate of Return (MIRR)". Explicitly defines MIRR using the cost of capital as the reinvestment rate, establishing the direct relationship (Rate $\uparrow$ $\rightarrow$ MIRR $\uparrow$).