It is now 1 January 20X0. Company V, a private equity company, is considering the acquisition of 40% of the equity of Company A for a total amount of $15 million. Company A has been established to develop a new type of engine which will be launched at the end of 20X1. Company A is forecasting that the new engine will result in free cash flows to equity of $2m in its first year of operation and that this will rise by 8% per year for the foreseeable future. The new engine is the only commercial activity that Company A is involved in. Company V intends to sell its stake in Company A when the new engine is launched. Company A has a cost of equity of 12%. Assuming that Company V receives an amount that reflects the present value of their shares in company A. what is the estimated annual rate of return to Company V from this investment? (To the nearest %)

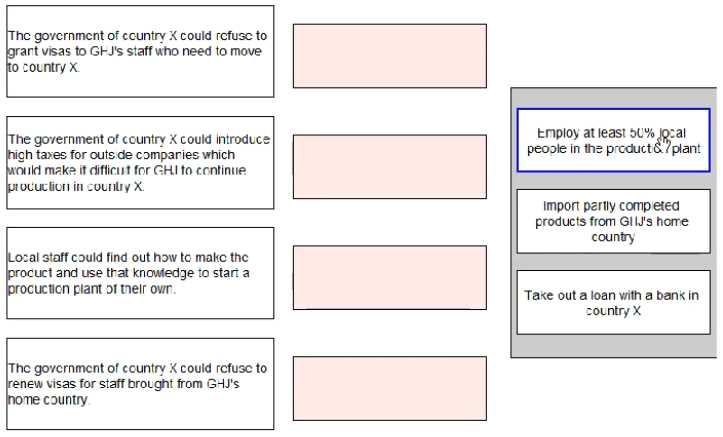

DRAG DROP CI IJ has decided to move its production plant to overseas country X. This would make the product cheaper to produce. The technology used to make the product is very advanced and some of the skilled staff would have to move to country X. The Production Director has identified that there are some political risks in moving to county X. For each of the political risks of moving to country X shown below, select the correct method for reducing the risk.

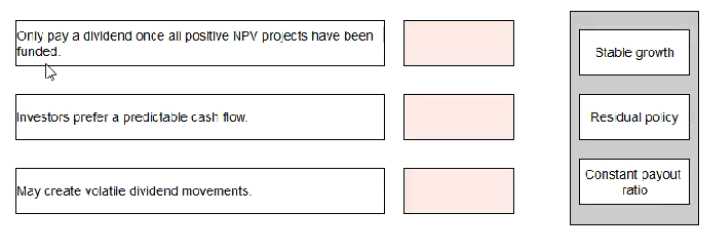

DRAG DROP Select the most appropriate divided for each of the following statements:

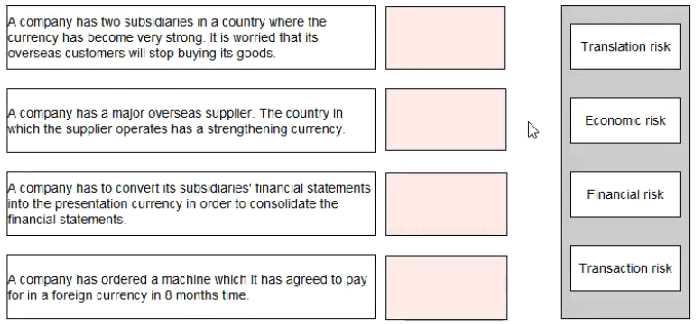

DRAG DROP Select the category of risk for each of the descriptions below:

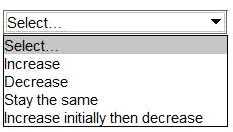

HOTSPOT A company's directors plan to increase gearing to come in line with the industry average of 40%. They need to know what the effect will be on the company's WACC. According to traditional theory of gearing the WACC is most likely to: