Q: 1

A project requires an initial outlay of $2 million which can be financed with either a bank loan or

finance lease.

The company will be responsible for annual maintenance under either option.

The tax regime is:

• Tax depreciation allowances can be claimed on purchased assets.

• If leased using a finance lease, tax relief can be claimed on the interest element of the lease

payments and also on the accounting depreciation charge.

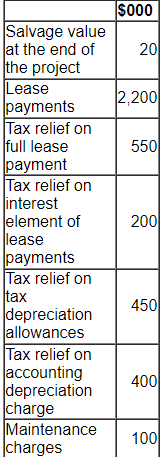

The trainee management accountant has begun evaluating the lease versus buy decision and has

produced the following dat

a. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

Using only the relevant data, which of the following is correct?

Using only the relevant data, which of the following is correct?

Using only the relevant data, which of the following is correct?Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

The following Information is relevant:

" The bonds were trading at $110 per $100 on 31 December 20X1. "Operating profit of BBA for the

year ended 31 December 20X1 was S15 million

• The P/E ratio is 8

* Corporate income tax rate is 20%.

The tax authorities m country B Implemented thin capitalisation rules based on the level of gearing

of the subsidiary, calculated as book value o( debt lo book value of equity The cut-off point for

gearing used by the tax authorities for a company to be thinly capitalised is 75%.

Which of the following statements is correct as at 31 December 20X1?

The following Information is relevant:

" The bonds were trading at $110 per $100 on 31 December 20X1. "Operating profit of BBA for the

year ended 31 December 20X1 was S15 million

• The P/E ratio is 8

* Corporate income tax rate is 20%.

The tax authorities m country B Implemented thin capitalisation rules based on the level of gearing

of the subsidiary, calculated as book value o( debt lo book value of equity The cut-off point for

gearing used by the tax authorities for a company to be thinly capitalised is 75%.

Which of the following statements is correct as at 31 December 20X1?