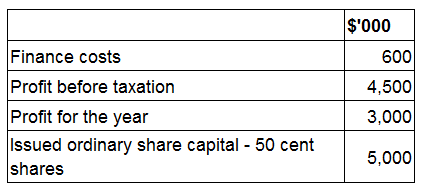

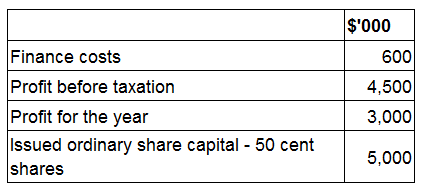

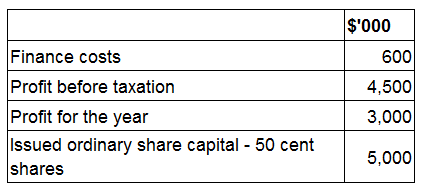

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?Q: 1

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 2

LM acquired an asset under a 5-year non-cancellable operating lease agreement on 1 January 20X8.

Under the terms of the agreement, LM paid nothing for the first year and then made four payments

of $50,000 in each subsequent year. LM adopted the provisions of IAS 17 Leases when accounting for

this agreement.

Which of the following is correct in respect of this operating lease in LM's financial statements for the

year to 31 December 20X8?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 3

LM acquired 80% of the equity shares of ST when ST's retained earnings were $50 million. The fair

value of the net assets of ST included a contingent liability with a fair value of $100 million at the

date of acquisition and a fair value of $40 million at 31 December 20X6. No other fair value

adjustments were required at the date of acquisition.

LM and ST had retained earnings of $200 million and $80 million respectively at 31 December 20X6.

The consolidated retained earnings of LM at 31 December 20X6 were:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 4

XY's investments enable it to exercise control over AB and have significant influence over FG and JK.

The Managing Director of XY is a non-executive director of LM. XY does not hold any investment

in LM.

XY is preparing its consolidated financial statements for the year ended 30 September 20X9.

Which of the following transactions during the year will be disclosed in these financial statements in

accordance with IAS 24 Related Party Disclosures?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 5

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights

and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to

participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its

consolidated financial statements?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 6

When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised

in the statement of profit or loss?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 7

AB and CD are competitors supplying components to the car manufacturing industry. AB operates in

Country X and CD operates in Country Y. Both entities were incorporated on the same day, are the

same size and prepare financial statements to 31 March each year using international accounting

standards.

Which of the following statements taken individually would limit the usefulness of the comparison of

the return on capital employed ratio between the two entities?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 8

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 9

What is the total comprehensive income attributable to the non-controlling interest that will be

presented in GHI's consolidated statement of changes in equity for the year ended 31 December

20X4?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 10

CORRECT TEXT

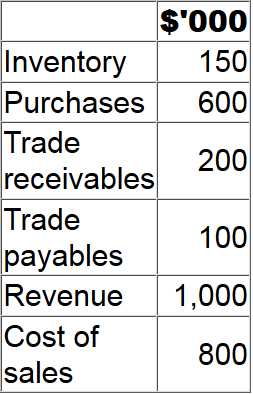

The following information has been extracted from the financial records of DEF for the year ended 31

December 20X2.

What is the operating cycle of DEF at 31 December 20X1?

Assume there are 365 days in the year.

All workings should be rounded to whole days.

Give your answer in whole days.

? days.

What is the operating cycle of DEF at 31 December 20X1?

Assume there are 365 days in the year.

All workings should be rounded to whole days.

Give your answer in whole days.

? days.

What is the operating cycle of DEF at 31 December 20X1?

Assume there are 365 days in the year.

All workings should be rounded to whole days.

Give your answer in whole days.

? days.

What is the operating cycle of DEF at 31 December 20X1?

Assume there are 365 days in the year.

All workings should be rounded to whole days.

Give your answer in whole days.

? days.Your Answer

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Question 1 of 20 · Page 1 / 2