CORRECT TEXT An entity bought a capital item for $110,000 on 1 March 20X4 incurring legal fees at the date of purchase of $2,500. On 1 May 20X4 additional costs classified as capital expenditure by the tax rules of the country of $25,000 were incurred in respect of the asset. On 1 June 20X4 repairs not classified as capital expenditure were incurred at a cost of $15,000. The asset was sold for $250,000 on 30 November 20X8 and costs to sell were incurred of $4,300. Calculate the chargeable gain on the disposal. Give your answer to the nearest $.

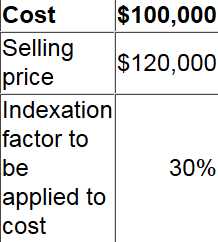

CORRECT TEXT Country ZZ allows the cost of a capital asset to be adjusted for an indexation allowance which takes into consideration the effect of inflation, although the indexation allowance cannot convert a chargeable gain into a chargeable loss. The following data relates to the sale of an asset during the year ended 31 March 20X4:

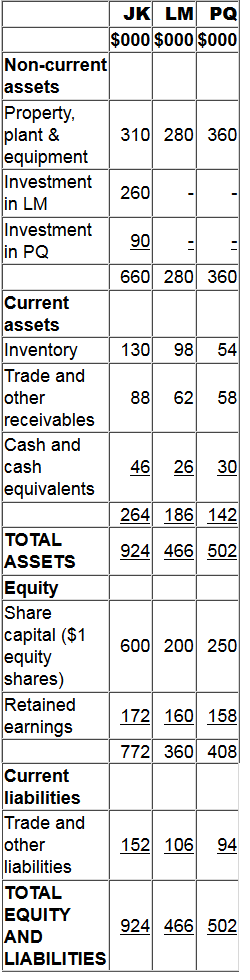

CORRECT TEXT Statements of financial position as at 31 December 20X8 for JK, LM and PQ are as follows:

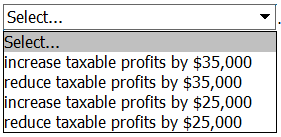

HOTSPOT AB sells to ST, a group entity, 10,000 units at $2.50 each. The market value was $6 each. The effect on AB of the transfer pricing legislation on this transaction would be to: .

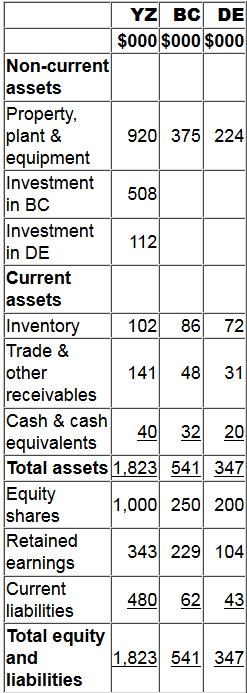

CORRECT TEXT Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

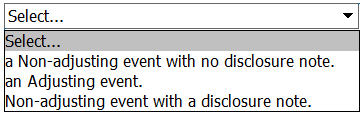

HOTSPOT LM received notification on 10 November 20X4 from one of its customers stating they had ceased trading as they had gone into liquidation. The balance outstanding at 31 October 20X4 was $150,000. In accordance with IAS 10 Events after the Reporting Date this event will be treated as:

CORRECT TEXT KL has just completed their inventory count and has ascertained that the cost value of the inventory is $460,000; this was made up of 10,000 units of component part FF. A week before the year end the FF components were moved to a temporary warehouse. Two weeks later they were inspected and found to have been damaged by the damp conditions in the temporary warehouse. Of the 10,000 units 2,500 of them were damaged. After remedial work of $5.00 per unit KL anticipates they will be able to sell the damaged parts for $32.00 per unit. What is the value for closing inventory to be included in the financial statements of KL? Give your answer to the nearest $.

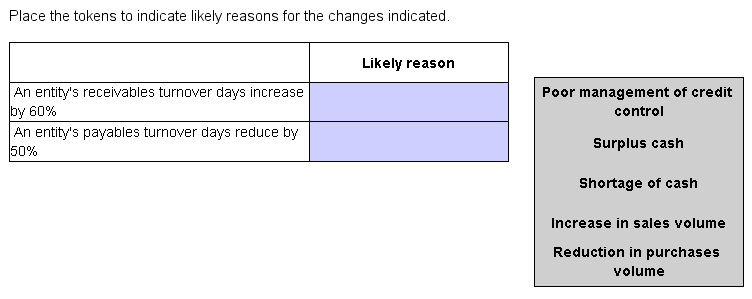

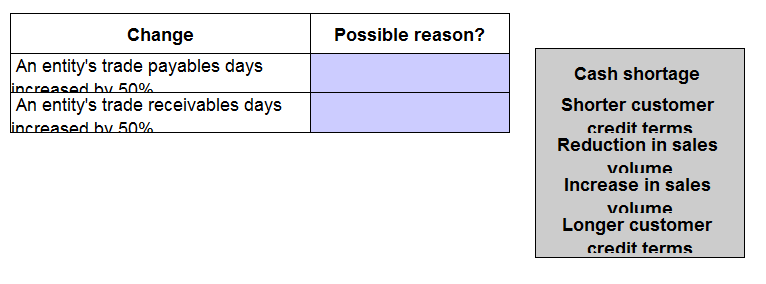

DRAG DROP

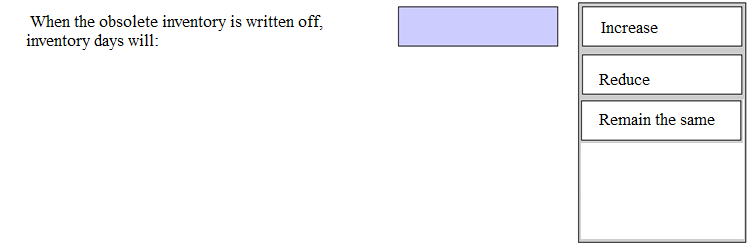

DRAG DROP An entity's inventory days are 45 days. An entity ceased to manufacture a product in 20X4. Raw materials used solely in the manufacture of that product are still held in inventory at 31 December 20X4. Place the appropriate response below to show how inventory days will be affected if this raw material inventory is written off as obsolete.