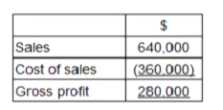

CORRECT TEXT An extract from PQ's statement of profit or loss for the year ended 31 March 20X6 is shown below:

CORRECT TEXT Refer to the exhibit.

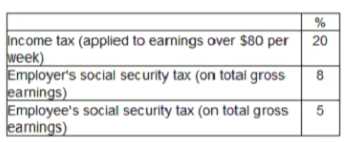

CORRECT TEXT EFG pays employees $10 per hour The following rates of tax and social security are applicable.

CORRECT TEXT A company has profit before tax and dividends of £500000. The share capital consists of 1000000 ordinary shares of £1 each and 100000 10% preference shares of 50p each. A 10p dividend was declared on ordinary shares. Assuming there was no tax liability for the period, profit retained for the period was

CORRECT TEXT A company uses the reduced balance method of depreciation for its company vehicles. The vehicles are depreciated at a rate of 30% per annum. On 31 March 2003 the company purchased a number of vehicles with a total cost of $200,000. The company's year-end is 31 December and it is company policy to charge a full year's depreciation in the year of acquisition. The carrying value of the vehicles at 31 December 2006 will be

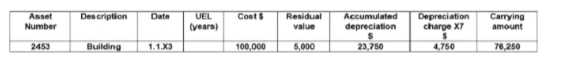

CORRECT TEXT DE has the following incomplete non-current register extract at 301 at December 20X7:

CORRECT TEXT The profit earned by Subramanian in 2006 was £ 50,000. He injected new capital of £12,000 during the year and withdrew goods for his private use that cost £4,000. If net assets at the beginning of 2006 were £10,000, what were the closing net assets?

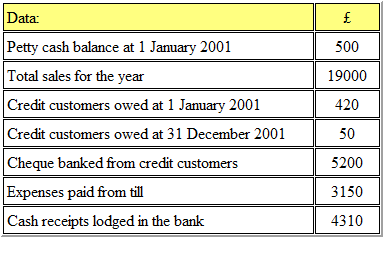

CORRECT TEXT Refer to the Exhibit.