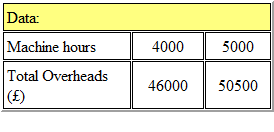

SP, a manufacturing company, uses a standard costing system. The standard variable production

overhead cost is based on the following budgeted figures for the year:

During the month of September, 5,300 actual hours were worked and 5,600 standard hours of output

were produced. Total variable production overhead costs in September were $8,600.

What was the variable overhead efficiency variance in September?

SP, a manufacturing company, uses a standard costing system. The standard variable production

overhead cost is based on the following budgeted figures for the year:

During the month of September, 5,300 actual hours were worked and 5,600 standard hours of output

were produced. Total variable production overhead costs in September were $8,600.

What was the variable overhead efficiency variance in September? SP, a manufacturing company, uses a standard costing system. The standard variable production

overhead cost is based on the following budgeted figures for the year:

During the month of September, 5,300 actual hours were worked and 5,600 standard hours of output

were produced. Total variable production overhead costs in September were $8,600.

What was the variable overhead efficiency variance in September?

SP, a manufacturing company, uses a standard costing system. The standard variable production

overhead cost is based on the following budgeted figures for the year:

During the month of September, 5,300 actual hours were worked and 5,600 standard hours of output

were produced. Total variable production overhead costs in September were $8,600.

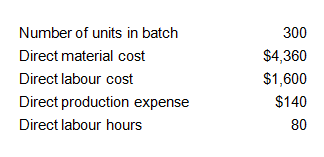

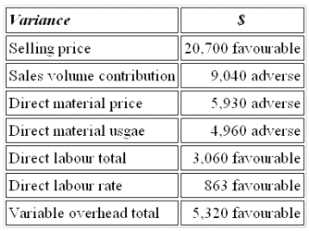

What was the variable overhead efficiency variance in September?CORRECT TEXT Refer to the exhibit.

CORRECT TEXT Refer to the Exhibit.

CORRECT TEXT Refer to the Exhibit.

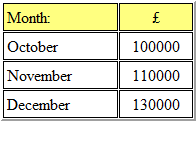

CORRECT TEXT PQR Manufacturing Ltd. has £3,000,000 of fixed costs for the forthcoming period. The company produces a single product 'X', which has a selling price of £75 per unit and total cost of £50. 75% of the total cost represents variable costs. How many units (to the nearest whole unit) will the organization need to produce and sell to generate a profit of £500,000?

CORRECT TEXT The selling price of product 'P' is £20 per unit. Variable costs are £6 per unit and total fixed costs are £140,000 each year. To earn a profit of £70,000 each year, the annual sales will need to be, to the nearest 1,000 units,

CORRECT TEXT Refer to the exhibit.

CORRECT TEXT Refer to the exhibit.

CORRECT TEXT Refer to the exhibit.