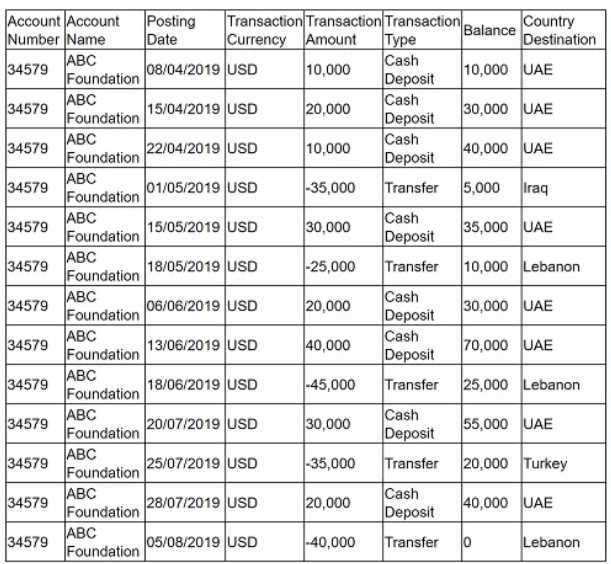

The relationship manager for ABC Foundation contacts the client to request more information on the

beneficiary of the transfer in Turkey. ABC Foundation advises that this is a not-for-profit charity group

called 'Forever Free." Which is the best next step in the investigation?

The relationship manager for ABC Foundation contacts the client to request more information on the

beneficiary of the transfer in Turkey. ABC Foundation advises that this is a not-for-profit charity group

called 'Forever Free." Which is the best next step in the investigation?A KYC specialist from the first line of defense at a bank initiates an internal escalation based on a letter of credit received by the bank. MEMO To: Jane Doe. Compliance Manager, Bank B From: Jack Brown, KYC Specialist, Bank B RE: Concerning letter of credit A letter of credit (LC) was received from a correspondent bank. Bank A. in Country A. in Asia with strict capital controls, providing guarantee of payment to Bank B's client for the export of 10 luxury cars located in Country B. located in Europe. Bank A's customer is a general in the army where Bank A is headquartered. The information contained in the LC is as follows: • Advising amount per unit 30.000.00 EU •10 units of BMW • Model IX3 • Year of registration: 2020 Upon checks on Bank B's client, the exporter mentioned that the transactions were particularly important, and a fast process would be much appreciated in order to avoid reputational damage to the firm and the banks involved in the trade finance process. The exporter has a longstanding relationship with Bank B and was clearly a good income generator. The exporter indicated that, as a general, the importer was trustworthy. The relationship manager