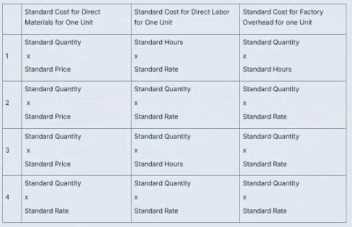

1. Heisinger, K., & Hoyle, J. B. (n.d.). Managerial Accounting. The Saylor Foundation. Chapter 10, Section 10.2, "Standard Costs." This text, aligned with the Saylor curriculum, specifies the formulas:

Direct Materials: "Standard quantity of direct materials × Standard price of direct materials"

Direct Labor: "Standard hours of direct labor × Standard rate for direct labor"

Overhead: "Standard hours of direct labor × Standard variable overhead rate" (demonstrating the use of a rate and standard hours).

2. Walther, L. M., & Skousen, C. J. (2009). Managerial and Cost Accounting. Bookboon. Chapter 8, "Standard Costs and Variance Analysis," pp. 78-79. This university-level textbook explicitly defines the components of a standard cost sheet as:

Direct material: "Standard Price X Standard Quantity"

Direct labor: "Standard Rate X Standard Hours"

Factory overhead: "Standard Overhead Rate X Standard Application Base" (where the base is often standard hours).

3. Garrison, R. H., Noreen, E. W., & Brewer, P. C. (2012). Managerial Accounting (14th ed.). McGraw-Hill/Irwin. Chapter 10, "Standard Costs and Variances," Exhibit 10-1, p. 428. This standard academic textbook illustrates a standard cost card with the exact formulas: "Standard Quantity or Hours (a) × Standard Price or Rate (b) = Standard Cost (a)×(b)." It applies this to materials, labor, and overhead.