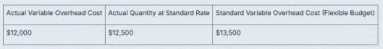

1. Heisinger, K., & Hoyle, J. B. (2012). Managerial Accounting. Saylor Foundation. In Chapter 10, Section 10.4, the variable overhead spending variance is defined as the difference between the actual variable overhead cost and the flexible budget amount based on the actual level of activity. The formula is equivalent to (Actual Cost) – (Standard Rate × Actual Activity). [See Section 10.4, "Overhead Variances"].

2. Walther, L. M., & Skousen, C. J. (2009). Managerial and Cost Accounting. Bookboon. In Chapter 9, "Variance Analysis," the variable overhead spending variance is detailed. The calculation compares the actual variable overhead with the flexible budget for the actual hours (or activity level), confirming the formula: Actual Cost - (Standard Rate x Actual Quantity of the cost driver). [See Chapter 9, pp. 78-79].

3. OpenStax, Rice University. (2019). Principles of Accounting, Volume 2: Managerial Accounting. Chapter 9, "Standard Costs and Variances." This text explains that the variable overhead rate variance (spending variance) "results from paying more or less than expected for variable overhead items." The calculation shown is consistent with the one used in the explanation. [See Section 9.3, "Compute and Evaluate Variable Overhead Variances"].