Q: 1

Under the credit migration approach to assessing portfolio credit risk, which of the following are

needed to generate a distribution of future portfolio values?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 2

According to the Basel framework, shareholders' equity and reserves are considered a part of:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 3

Economic capital under the Earnings Volatility approach is calculated as:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 4

An error by a third party service provider results in a loss to a client that the bank has to make up.

Such as loss would be categorized per Basel II operational risk categories as:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 5

Which of the following are true:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 6

Which of the following statements is true:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 7

Under the CreditPortfolio View model of credit risk, the conditional probability of default will be:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 8

The probability of default of a security during the first year after issuance is 3%, that during the

second and third years is 4%, and during the fourth year is 5%. What is the probability that it would

not have defaulted at the end of four years from now?

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 9

An assumption regarding the absence of ratings momentum is referred to as:

Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Q: 10

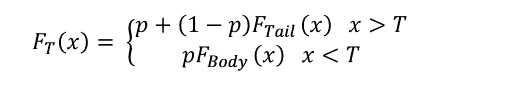

When fitting a distribution in excess of a threshold as part of the body-tail distribution method

described by the equation below, how is the parameter 'p' calculated.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for

the tail and the body, and T is the threshold in excess of which the tail is considered to begin.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for

the tail and the body, and T is the threshold in excess of which the tail is considered to begin.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for

the tail and the body, and T is the threshold in excess of which the tail is considered to begin.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for

the tail and the body, and T is the threshold in excess of which the tail is considered to begin.Options

Discussion

No comments yet. Be the first to comment.

Be respectful. No spam.

Question 1 of 20 · Page 1 / 2