AICPA CPA Regulation

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom’s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom’s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores’ 1994 Form 1040. The Moores received $8,400 in gross receipts from their rental property during 1994. The expenses for the residential rental property were:

DAC Foundation awarded Kent $75,000 in recognition of lifelong literary achievement. Kent was not required to render future services as a condition to receive the $75,000. What condition(s) must have been met for the award to be excluded from Kent's gross income? I. Kent was selected for the award by DAC without any action on Kent's part. II. Pursuant to Kent's designation, DAC paid the amount of the award either to a governmental unit or to a charitable organization.

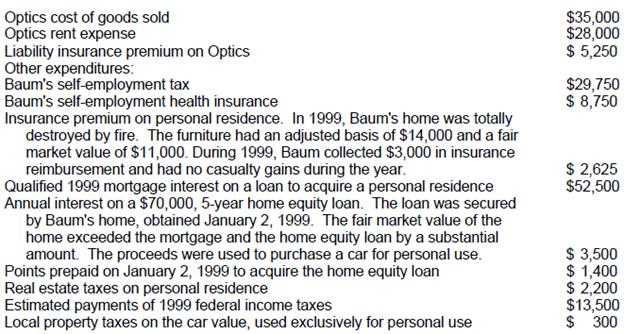

What amount should Baum report as 1999 net earnings from self-employment?

What amount should Baum report as 1999 net earnings from self-employment?Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom’s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom’s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores’ 1994 Form 1040. The Moores received a stock dividend in 1994 from Ace Corp. They had the option to receive either cash or Ace stock with a fair market value of $900 as of the date of distribution. The par value of the stock was $500.

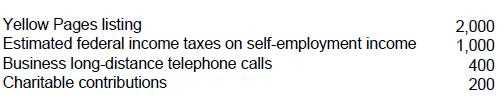

What amount should Rich report as net self-employment income?

What amount should Rich report as net self-employment income?